USD Account for Remote Workers and Freelancers

USD Account for Remote

Workers and Freelancers

USD Account for Remote Workers

and Freelancers

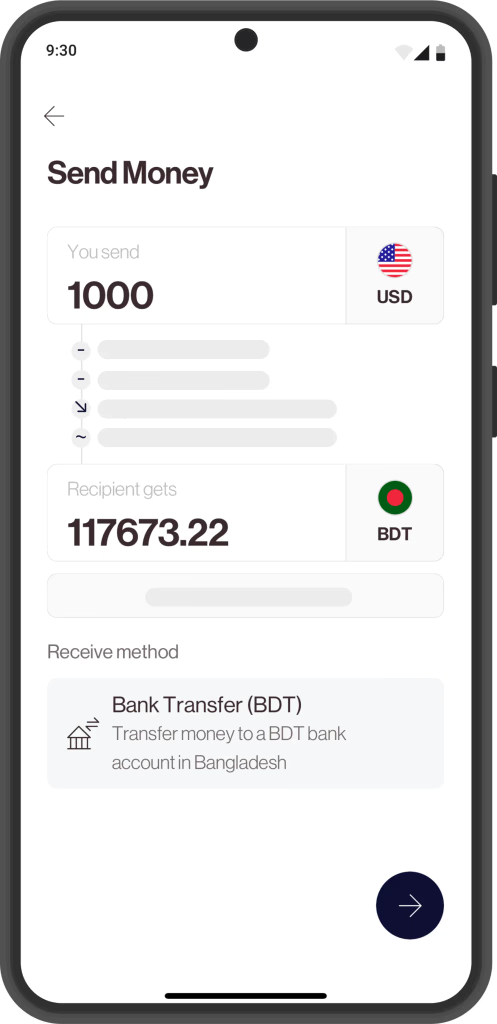

Receive payments from Upwork, Fiverr, Deel, Toptal, or any US bank via ACH and Wire transfers.

Receive payments from Upwork, Fiverr, Deel, Toptal, or any US bank via ACH and Wire transfers.

Receive payments from Upwork, Fiverr, Deel, Toptal, or any US bank via ACH and Wire transfers.

MAETUS31XXX

MAGNA SECURITIES BIC/SWIFT Code Details

MAGNA SECURITIES

Copy the code

MAETUS31XXX

MAETUS31XXX

MAETUS31XXX

MAETUS31XXX

Let's decode these letters and numbers

A SWIFT code, sometimes referred to as a SWIFT number, is a standardized format for Business Identifier Codes (BIC). Banks and financial institutions use these codes as an international bank code or ID that reveals who they are and where they are located.

These codes are primarily used for transferring money between banks, especially for international money transfers or SEPA payments. Banks also rely on SWIFT codes to exchange messages between one another.

Copy the code

MAETUS31XXX

MAETUS31XXX

MAETUS31XXX

MAETUS31XXX

MAGNA SECURITIES

MAGNA SECURITIES

MAGNA SECURITIES

MAET

Bank code

US

Country code

31

Location code

XXX

Branch code

This SWIFT code identifies MAGNA SECURITIES

MAGNA SECURITIES BIC/SWIFT Code

SWIFT

MAETUS31XXX

SWIFT code (8 characters)

MAETUS31

SWIFT code (8 characters)

MAETUS31

SWIFT code (8 characters)

MAETUS31

SWIFT code (8 characters)

MAETUS31

Branch name

MAGNA SECURITIES

Branch name

MAGNA SECURITIES

Branch name

MAGNA SECURITIES

Branch name

MAGNA SECURITIES

Branch code

XXX

Branch code

XXX

Branch code

XXX

Branch code

XXX

Bank name

MAGNA SECURITIES

Bank name

MAGNA SECURITIES

Bank name

MAGNA SECURITIES

Bank name

MAGNA SECURITIES

City

NEW YORK,NY

City

NEW YORK,NY

City

NEW YORK,NY

City

NEW YORK,NY

Country

United States

Country

United States

Country

United States

Country

United States

A SWIFT/BIC is an 8-11 character code that identifies your country, city, bank, and branch.

A SWIFT/BIC is an 8-11 character code that identifies the country, city, bank, and specific branch associated with your account.

Bank code A-Z

Four letters represent the bank, typically appearing as a shortened version of the bank's name.

Bank code A-Z

Four letters represent the bank, typically appearing as a shortened version of the bank's name.

Bank code A-Z

Four letters represent the bank, typically appearing as a shortened version of the bank's name.

Bank code A-Z

Four letters represent the bank, typically appearing as a shortened version of the bank's name.

Country code A-Z

Two letters represent the country where the bank is located.

Country code A-Z

Two letters represent the country where the bank is located.

Country code A-Z

Two letters represent the country where the bank is located.

Country code A-Z

Two letters represent the country where the bank is located.

Location code 0-9 A-Z

Two characters, made up of letters or numbers, indicate the location of the bank's head office.

Location code 0-9 A-Z

Two characters, made up of letters or numbers, indicate the location of the bank's head office.

Location code 0-9 A-Z

Two characters, made up of letters or numbers, indicate the location of the bank's head office.

Location code 0-9 A-Z

Two characters, made up of letters or numbers, indicate the location of the bank's head office.

Branch Code 0-9 A-Z

The three digits specify a particular branch, while 'XXX' represents the bank’s head office.

Branch Code 0-9 A-Z

The three digits specify a particular branch, while 'XXX' represents the bank’s head office.

Branch Code 0-9 A-Z

The three digits specify a particular branch, while 'XXX' represents the bank’s head office.

Branch Code 0-9 A-Z

The three digits specify a particular branch, while 'XXX' represents the bank’s head office.

Double-check with Your Recipient

Double-check with Your Recipient

When sending or receiving money, always verify the SWIFT code with your recipient or bank.

When sending or receiving money, always verify the SWIFT code with your recipient or bank.

If you believe you've used the wrong SWIFT code, contact your bank immediately. They might be able to cancel the transaction. If it's too late, you may need to reach out to the recipient directly to request a return of your funds.

If you believe you've used the wrong SWIFT code, contact your bank immediately. They might be able to cancel the transaction. If it's too late, you may need to reach out to the recipient directly to request a return of your funds.

Frequently Asked Questions

What is a SWIFT code, and why do I need it?

What is a SWIFT code, and why do I need it?

What is a SWIFT code, and why do I need it?

What is a SWIFT code, and why do I need it?

How do I find the correct SWIFT code for my bank?

How do I find the correct SWIFT code for my bank?

How do I find the correct SWIFT code for my bank?

How do I find the correct SWIFT code for my bank?

What happens if I use the wrong SWIFT code?

Is there a fee for converting currency?

What happens if I use the wrong SWIFT code?

What happens if I use the wrong SWIFT code?

Is there a difference between a SWIFT code and a BIC code?

How accurate are the rates provided?

Is there a difference between a SWIFT code and a BIC code?

Is there a difference between a SWIFT code and a BIC code?

Terms and Policies

© 2025 Elevate Pay. Bloom Financial Technologies Inc trading as Elevate Pay is a financial technology company, not an FDIC insured depository institution. Banking services provided by Bangor Savings Bank, Member FDIC. FDIC insurance coverage protects against the failure of an FDIC insured depository institution. Pass through FDIC insurance coverage is subject to certain conditions.

Terms and Policies

© 2025 Elevate Pay. Bloom Financial Technologies Inc trading as Elevate Pay is a financial technology company, not an FDIC insured depository institution. Banking services provided by Bangor Savings Bank, Member FDIC. FDIC insurance coverage protects against the failure of an FDIC insured depository institution. Pass through FDIC insurance coverage is subject to certain conditions.

Terms and Policies

© 2025 Elevate Pay. Bloom Financial Technologies Inc trading as Elevate Pay is a financial technology company, not an FDIC insured depository institution. Banking services provided by Bangor Savings Bank, Member FDIC. FDIC insurance coverage protects against the failure of an FDIC insured depository institution. Pass through FDIC insurance coverage is subject to certain conditions.

Terms and Policies

© 2025 Elevate Pay. Bloom Financial Technologies Inc trading as Elevate Pay is a financial technology company, not an FDIC insured depository institution. Banking services provided by Bangor Savings Bank, Member FDIC. FDIC insurance coverage protects against the failure of an FDIC insured depository institution. Pass through FDIC insurance coverage is subject to certain conditions.