How to Withdraw My Money From Upwork

Layla Mansoor

Getting paid is without a doubt the most rewarding part of being a freelancer. But a lot of freelancers, especially those living in emerging market countries like Pakistan, Egypt, and Kenya are losing part of their hard-earned income because of the methods they use to withdraw funds from Upwork. Let’s take you through the different ways of withdrawing your money and set you on the right path to keeping as much of your money as possible.

Setting up a Payment Method

The process starts with selecting the most appropriate payment method. This is how you can set up a withdrawal method of choice:

Login to Upwork

Start by logging in to your Upwork account on your desktop/laptop device.

Go to ‘Settings’

Go to your profile at the top right and enter “Settings,” where you may be prompted to authenticate yourself again.

Find ‘Get Paid’

Under “User Settings” you will find “Get Paid.” Click on it to add a new withdrawal method.

Click ‘Add a Method’

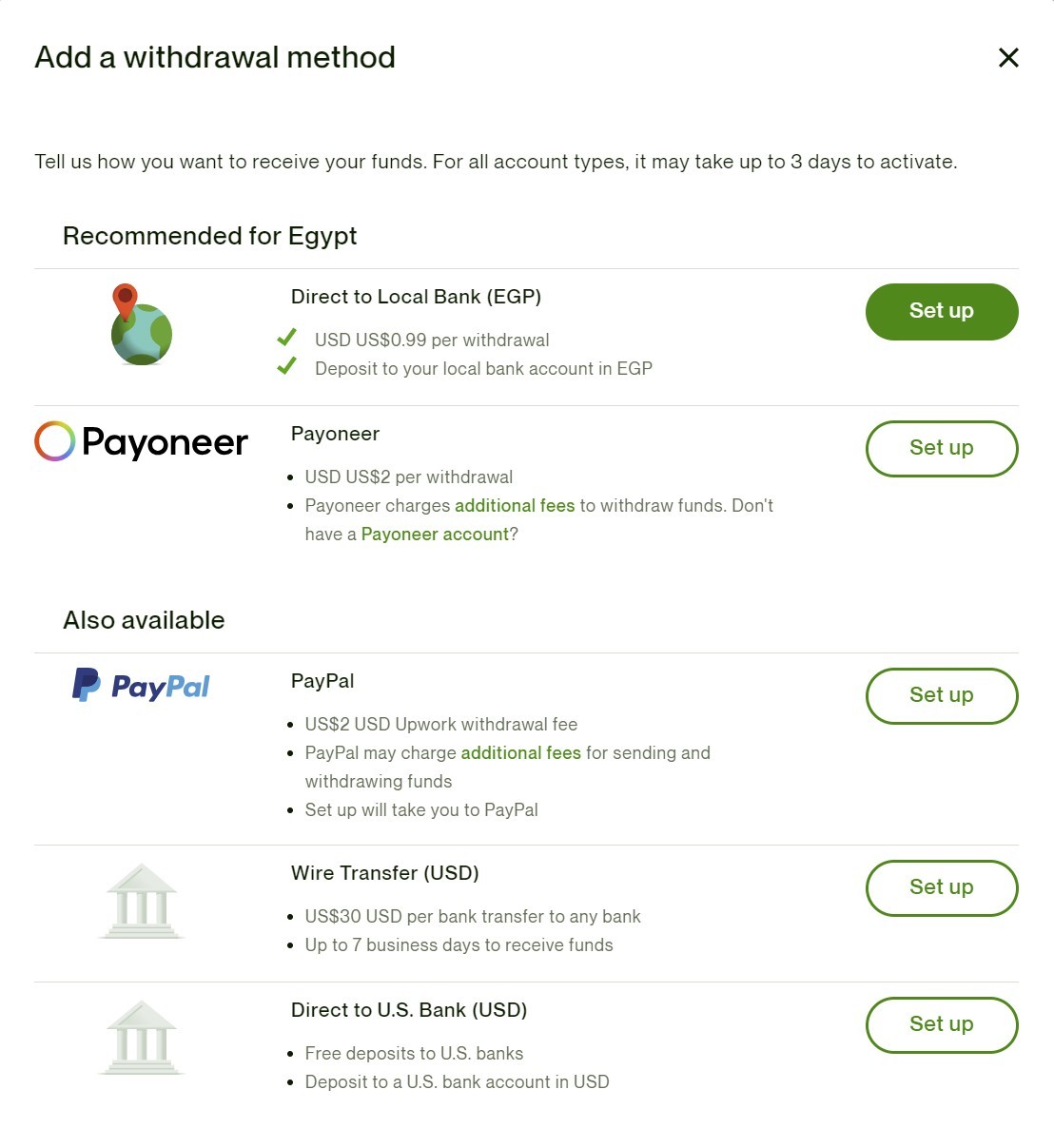

On the new pop-up, select “Add Method,” and a number of withdrawal methods should appear, as in the image below.

Select Your Withdrawal Method

This is a very complicated step in the process because of all the options you have. Depending on your country Upwork will provide a number of “Recommendations”. In this example of Egypt, the recommendations are a “Direct to Local Bank (EGP)” transfer and “Payoneer”.

Although Upwork has made those recommendations with the best intentions, they are not always the cheapest option, especially for freelancers working in emerging markets. Let’s take a look at the options and dig a little deeper into the fees, time taken to get paid, as well as the pros and cons.

i) Direct to Local Bank

This method involves Upwork sending your money directly to your local bank account. In Egypt or Pakistan for example it would be your local bank account you’ve set up with the money being received in EGP or PKR respectively.

Upwork charges $0.99 when sending to your local bank. This is relatively cheap in comparison to the other options but be aware that your bank may charge additional fees and an exchange rate that may be unfavorable.

Transfers typically take 2-5 business days but can take up to 7. You should contact the Upwork support team if it takes any longer than that.

Pros

Relatively low Upwork fees.

Receive the money directly to your home account.

Cons

The exchange rates may not always be favourable.

Your bank may apply fees that are not always upfront and transparent.

ii) Payoneer

Payoneer tends to be recommended by default for most emerging market countries and allows you to receive the payment into their USD wallet.

Upwork charges $2 when sending to Payoneer which can be expensive depending on how much you're withdrawing. Payoneer itself will then apply fees to money that is received into the account. Transfers from Upwork to Payoneer can typically take up to 24 hours.

Pros

Relatively quick time to receive your payments.

Payments are in USD.

Cons

Not great for smaller transfers because of the $2 fee by Upwork and minimums by Payoneer.

Expect additional fees when receiving the payment and when then sending the money back to your home country

iii) PayPal

PayPal is a well-known payment platform that has been around for a while. Although they have a reputation of being quite expensive it’s been a popular and trusted method of accepting payments for many freelancers and businesses in emerging markets.

Upwork charges $2 when sending to PayPal which like Payoneer can be an issue with smaller amounts.

Transfers can take up to 24 hours.

Pros

Relatively quick time to receive your payments.

Payments are in USD.

PayPal is a trusted provider that has been around for a long time.

Cons

Not great for smaller transfers because of the $2 fee by Upwork and minimums by PayPal.

iv) Wire

For those with a US account, domestic wires are an option, but one that is rarely used simply because of the excessive cost of the transfer. Wires are typically used for larger transactions in the U.S. and are not really suited to freelancing.

A wire transfer can be very costly as Upwork charges $30 for it. Wire transfers are costly because they are generally completed either the same day or within 1-2 days. However, in some cases it can take up to 7 days.

Pros

Payments are in USD.

Payment can be quite swift and you can track the payment as well.

Cons

It is very costly to complete a wire transfer.

v) Direct to US Bank (Recommended)

Last but not least, getting paid directly into a US-based USD account. This is in fact an ACH bank transfer. Although the bottom of the list on Upwork, it’s the only free method. There's no Upwork fees for a direct transfer to US bank, but your US bank may charge you an inbound fees. This transfer typically completes within one business day.

Pros

Free

Quick

Payment is in USD

Cons

Depending on your bank there may be fees when sending money home.

You may be wondering why the only free option of “Direct to U.S Bank (USD)” is the last suggestion by Upwork. The answer is relatively simple, most residents in emerging markets simply don’t have access to a US bank account and so are locked out of this withdrawal method. Elevate Pay is solving that problem by offering free US-based USD accounts, in partnership with Bangor Savings Bank, to freelancers all over the world.

Use this account to receive USD from Upwork, other freelance platforms or global USD payments in your account. You can continue to transfer money home very easily by connecting your local payment method to Elevate Pay.

Setup Account Details

After carefully picking up a withdrawal method, continue to add the account details for your chosen method. This is followed by verification the duration for which can vary depending on the payment method you choose.

Get Paid

To finally get paid, go to Settings -> User Settings -> Get Paid and click on 'Get Paid Now'. Type in the amount you wish to transfer and proceed to receive the funds in your account.

Tips to Setup your Withdrawal Method

Here are a few extra tips when setting up your withdrawal method from Upwork that will help prevent any issues in receiving your money.

Enter the Correct Name

Make sure that the name you’ve registered with your bank account matches the name you have verified with Upwork. If you don’t, this may cause delays in receiving payments that will need to be resolved by the Upwork support team.

Always Double Check Details

Always double-check the account numbers and bank codes your entering. With “Direct to bank US” for example ensure you have entered the routing and account number correctly. You’re routing number once entered should load up your bank to display, when using Elevate Pay this will be our partner Bangor Savings Bank.

Be Mindful of Three Day Setup Time

Whichever method you choose it will typically take up to three days for the method to be added. As an added tip always make sure that your payment account is set up under the same name as your Upwork account.

Verify Information With Your Bank

If you’re ever unsure of any of the information you need to enter make sure you contact your bank. Elevate Pay prides itself on having exceptional customer support to help resolve any issues.

Why You Should Choose Elevate Pay as a Freelancer?

While there are multiple options to withdraw your money as a freelancer here’s why we think Elevate Pay offers you the best solution:

You’ll get a free USD account to enable the “Direct to Bank US” option to receive and save your money in USD.

We offer you the ability to send money home at market exchange rates.

For certain countries, like Egypt and Nigeria, we offer you the ability to send USD back to your home country's USD account at rates that are 4x cheaper than SWIFT and can be as fast as same-day settlement.

Conclusion

Upwork offers multiple payout methods to empower its users with options and pick the right one for themselves. However, some limiting factors leave emerging markets with more costly solutions. In this blog, you not only learned to withdraw your funds from Upwork, but also determined how you can save money doing so.