Everything You Need to Know About Managing Your Elevate Pay Account

Mesan Ali

As a platform designed to facilitate USD banking, Elevate Pay offers a range of features that cater to the unique needs of its users. Whether you are setting up your account for the first time or seeking to optimize your existing account, this comprehensive guide will cover everything you need to know.

From receiving payments and withdrawing funds to understanding transaction fees and utilizing customer support, we’ll help you easily navigate the Elevate Pay platform. Discover how to maximize your Elevate Pay account and enhance your financial management experience.

Elevate Pay gives you a free USD checking account. This account allows you to receive USD through multiple means and send money home with low fees and the best FX rates.

Let’s dive into your experience with an Elevate Pay account, starting with sign-up.

Sign-up/Sign-in

If you haven’t already signed up for your Elevate Pay account, it’s a simple three-step process. Start by downloading the application on your smartphone. Tap ‘Sign-up’ and enter all the required details. This is followed by the Know Your Customer Process, where you verify your identity and provide some required documents. After verification, your account is ready, and you can start sending money.

Once you have created your account, you do not always need your email address and password to sign in. The Elevate Pay App offers a biometric sign-in option for enhanced security and a smoother experience.

Security & Privacy

Apart from biometric login, the app has other features to support your security and privacy concerns.

2 Factor Authentication

If you choose not to use the biometric sign-in option, 2FA will always be enabled on your account for added security. Elevate will send a 6-digit security code to your registered contact number, which you can enter to log in.

This is not it; all your transactions are also protected by 2FA, ensuring additional security.

Real-Time Notifications

You deserve to be notified of any activity on your account. Therefore, Elevate Pay provides real-time notifications for all transactions, sign-ins, and any other activity on your account. So, if there’s any unauthorized activity, you will be notified immediately so you can take the proper steps to intervene.

Shake Gesture

You can always feel skeptical about using your banking application in public. The shake gesture is a unique feature that hides your balance while using the app. Just shake your device, and your account balance will be blurred on the screen. You can shake it again to unhide it. You can enable the shake gesture by going to Profile -> Settings -> Enable Shake Gesture.

Once you log in to your application, you will see a navigation panel at the bottom of your screen, which tells you which screen you are on. You start your journey on the home screen.

Options on Your Home Screen

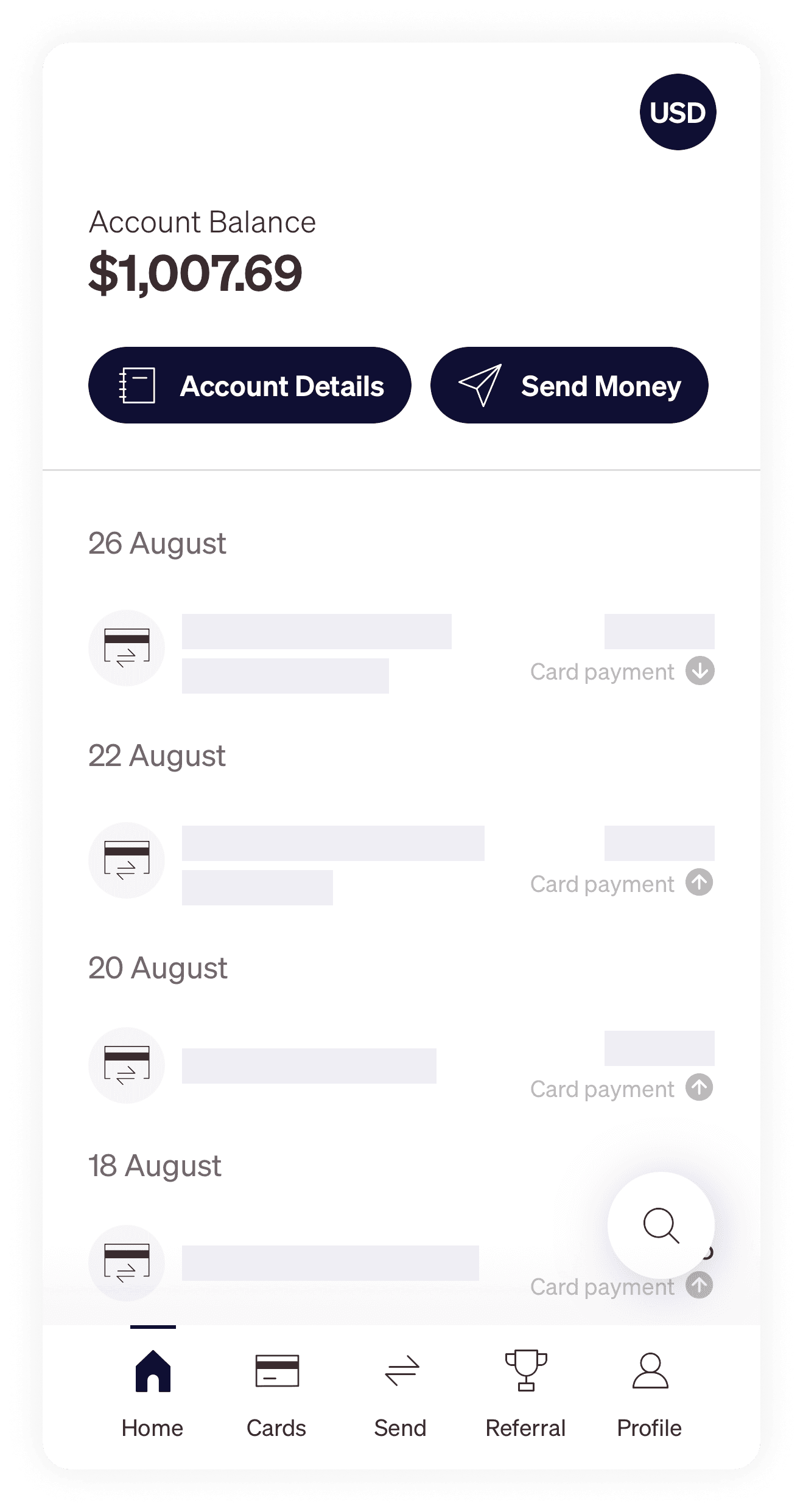

You will see your home screen when you sign in to your Elevate Pay account, which looks like this.

This is where you see a list of all the transactions on your account and several other options. You can use this screen to navigate through your transactions or move on to any other section to perform other tasks.

Account Details

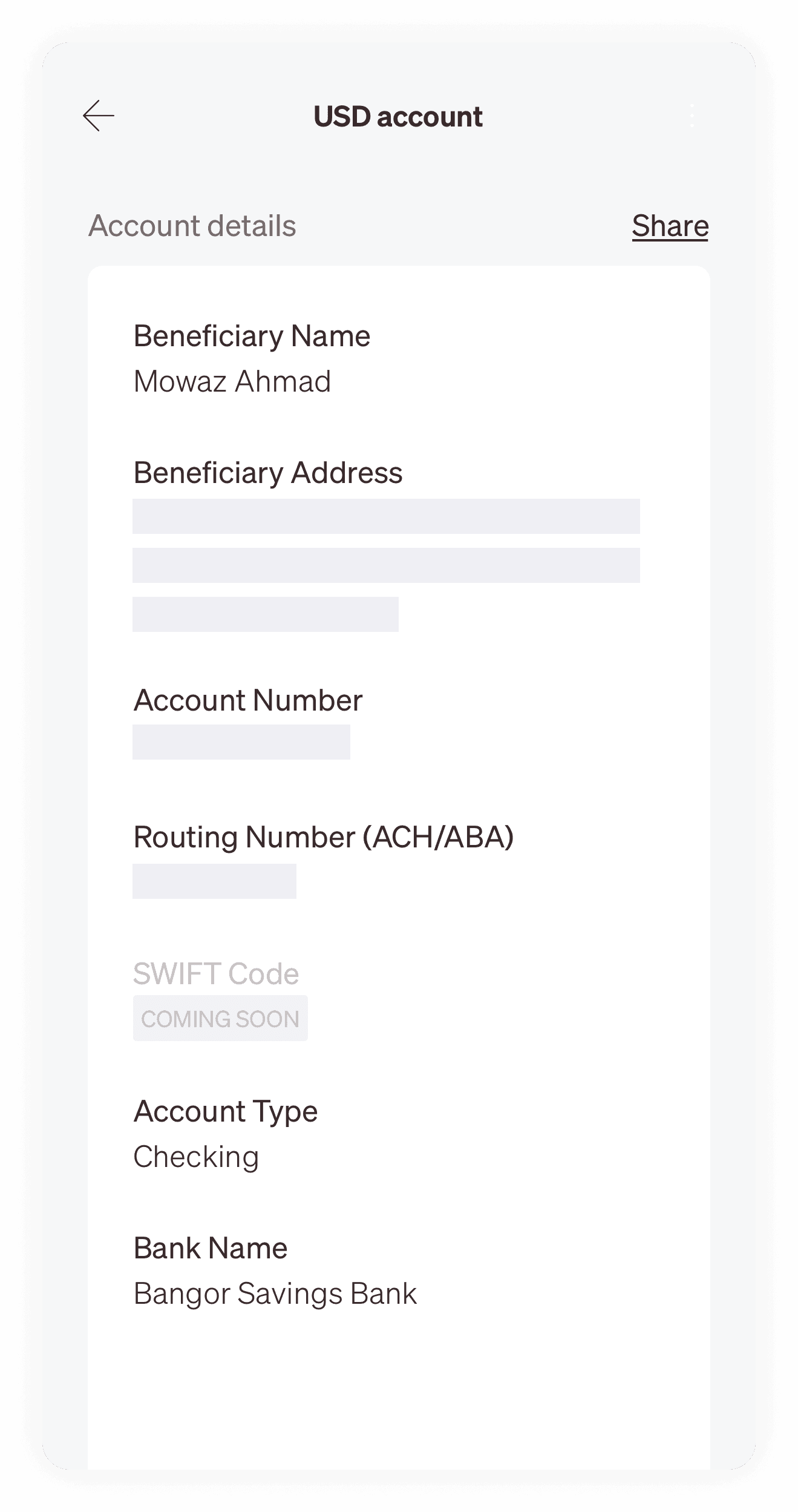

On the left-hand side, you see the button to view your account details. Tap on this button to see all the details about your account, including account title, account number, routing number, address, and more. This is what your account details screen looks like:

You will also see a share button on this screen, which you can tap to share your account details. This will allow you to share all the details required to receive money in your account.

Send Money

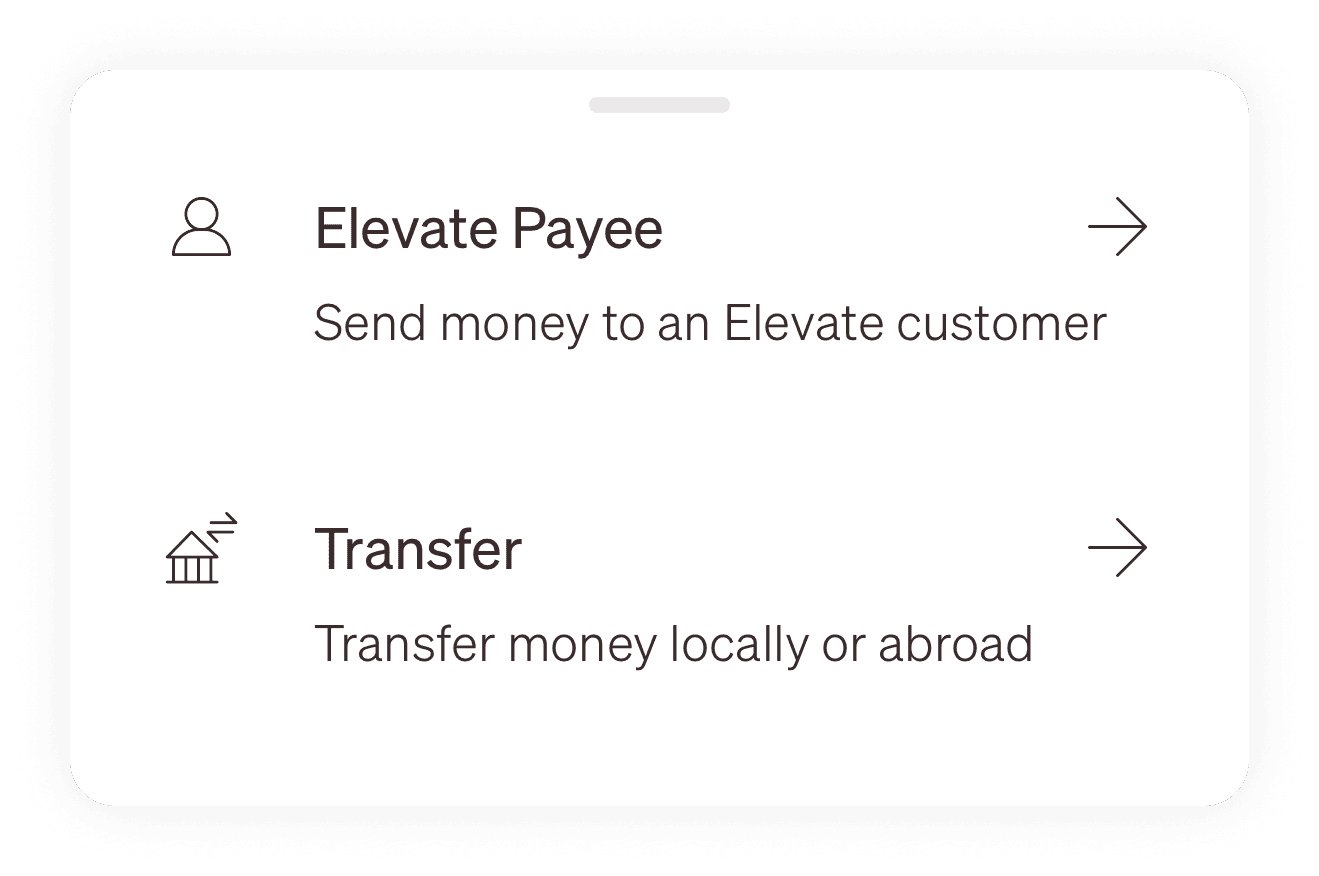

Another option on the home screen is ‘Send Money.’ If you want to send some funds, tap this button to see two options. To send money to another Elevate Pay account, or locally or abroad. You can then proceed according to the needs of your desired transfer.

Another option on your navigation bar is ‘Cards.’

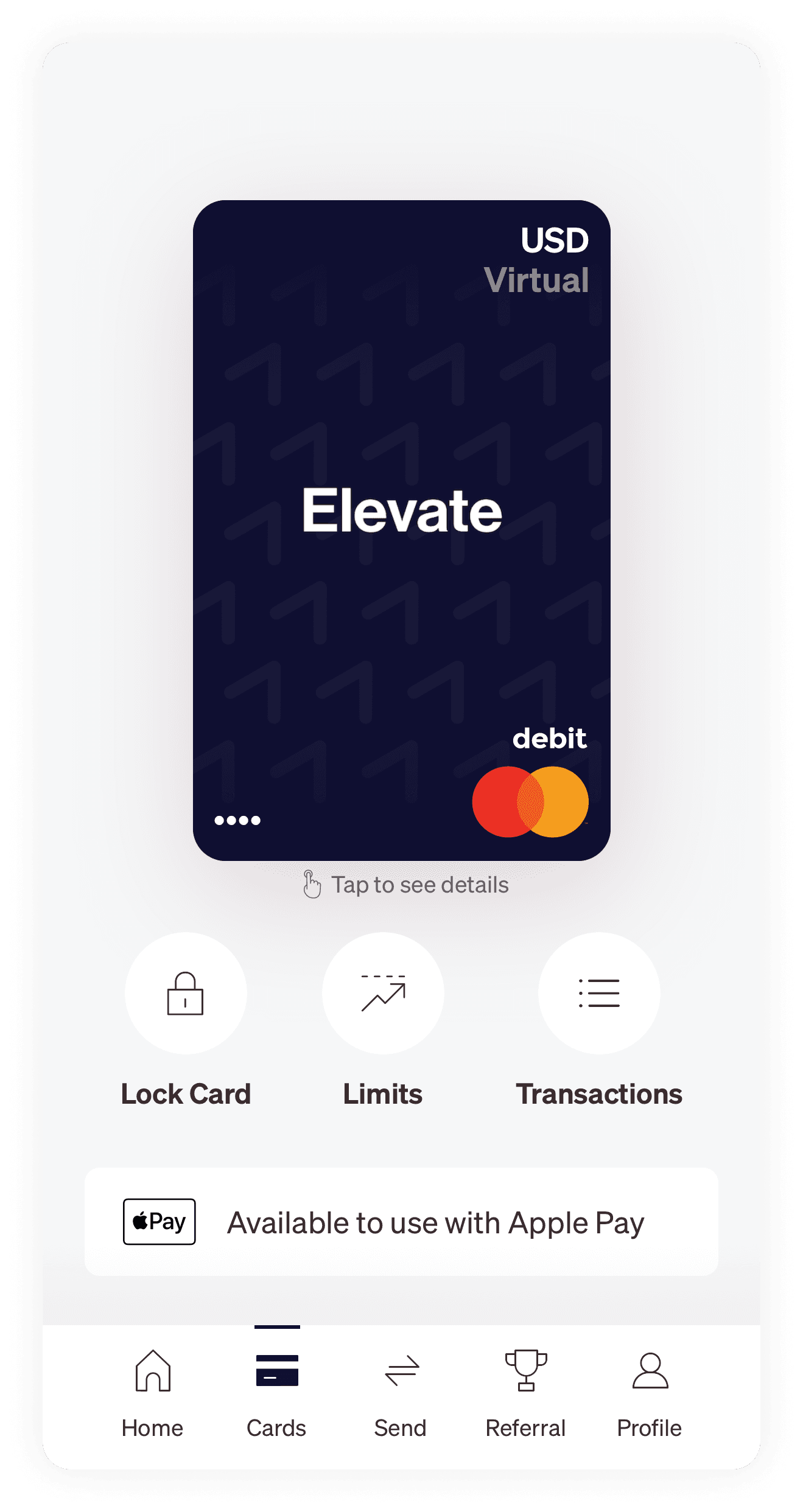

Managing Your Cards on Elevate Pay

Once you tap ‘Cards,’ you will see your virtual Elevate Pay Card(s). Initially, the card details are hidden, but you can just tap on it, and it will flip to show all the card details, including card number, security code, and expiration date.

Then, you see three more options. To lock your card, see all the limits and view the history of transactions. Finally, depending on your device type, you can see the option to use your card with Google Pay or Apple Pay.

Sending Funds

Once you navigate to the ‘Send’ button, you will see two options, as mentioned above.

Transfer to Elevate Payee

Using this option, you can send funds to another Elevate Pay user. To add them as a beneficiary, you need only the email address associated with their account. Once added, you can enter the amount and send it.

Transfer Locally or Abroad

This is the option you can use if you want to send money back home or to another supported region. You start by choosing the country you wish to send funds to, and then you will see a list of options like local wallets or bank transfers that you can select from. Once you do, add all the account details to add a beneficiary and send money.

Before you complete your transfer, you will see all the transaction details, including the amount sent, conversion rate, platform fee, and the total amount the receiver will get. This is what your transaction screen will look like before you send:

Receiving Funds

Receiving money on Elevate Pay is relatively straightforward and basic. Share your relevant account details with the 3rd party, and they can send you USD using ACH which is supported by all major freelance platforms including local US accounts. However, it should be a USD payment since your Elevate Pay account can only receive funds in USD yet.

You can also receive funds in your account directly from freelance platforms like Upwork and Fiverr.

Profile

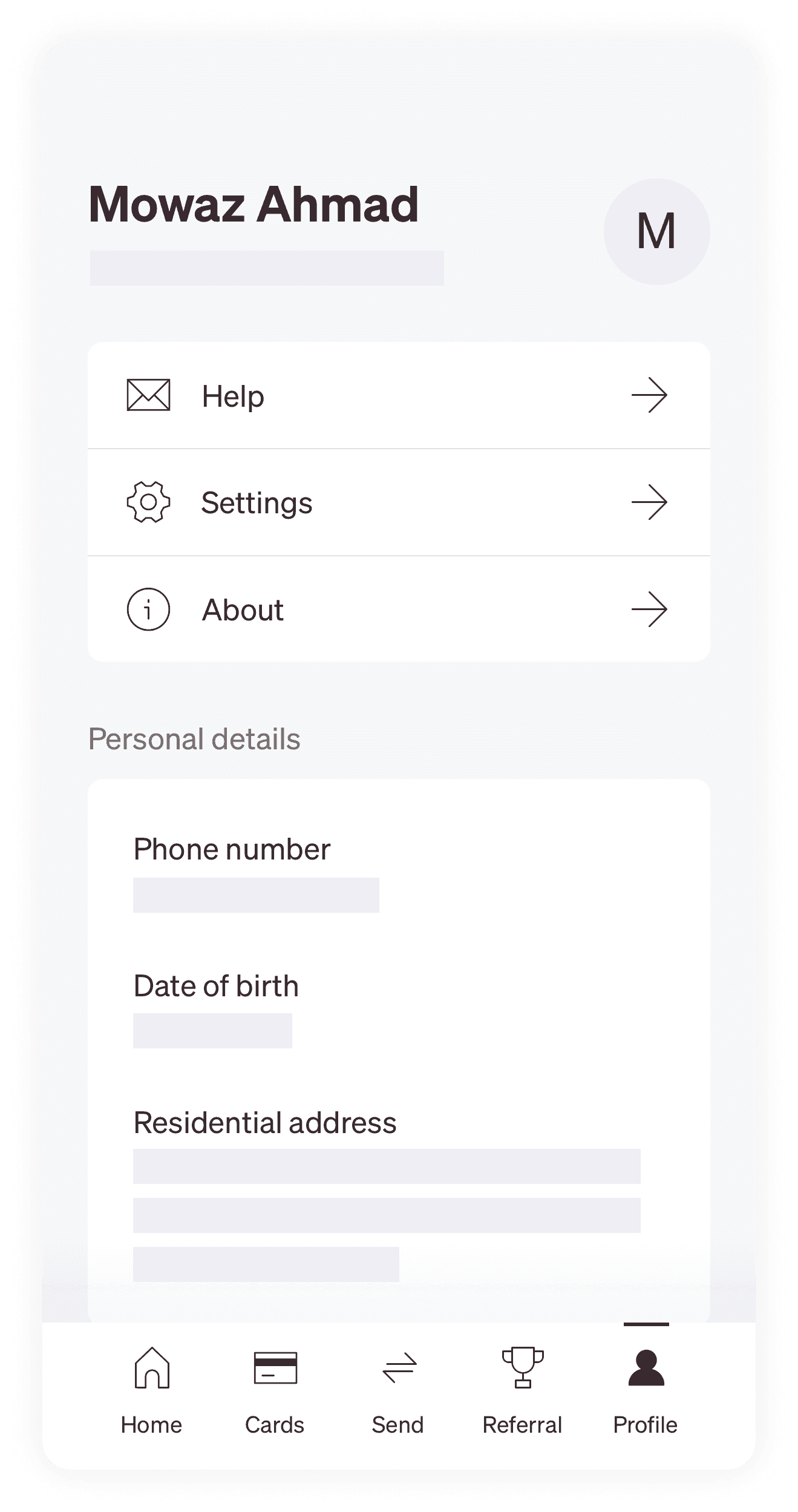

You will also see the ‘Profile’ option in the navigation bar. This is where you can see your details saved with Elevate Pay and access other essential options like Help, Settings, and About.

Refer to ‘About’ for all terms and conditions and company policy if you need to look for any. You can also find the option to request a feature because Elevate Pay is about improving your experience and is open to customer suggestions.

In ‘Settings,’ you can personalize the app to enable biometric authentication, change language, and explore other features. Finally, under ‘Help,’ you can find ways to contact customer support and refer to FAQs.

Help and Support

Elevate Pay is dedicated to providing excellent customer service and uses multiple channels for it. To receive immediate support, you can call, send an email, or get live in-app chat. With all these options available 24/7, you can use whatever suits your convenience.

You can also access FAQs directly from the app. Here, you can find solutions to your challenges without contacting customer service.

Referrals

Looking to earn some bonus funds? Once you have an account, you can jump to ‘Referrals’ and refer Elevate Pay to a friend. You get $10 for every friend who completes $1000 in international transactions using Elevate Pay.

Conclusion

Effectively managing your Elevate Pay account is crucial for maximizing its benefits and ensuring a seamless financial experience. You can take full advantage of the platform's features by understanding how to set up your account, receive and withdraw funds, and monitor your transactions. Knowing how to manage your cards, seamlessly integrating freelance platforms, and contacting customer service at a glance will further enhance your experience.

As you continue to leverage Elevate Pay for your financial transactions, you’ll find that it simplifies your payment processes and empowers you to manage your finances confidently.