Six-Figure Remote Income: Still 'Too Risky' for Credit Cards in Bangladesh

Tanvirul Islam

Credit Cards are the backbone of economic development in any rising economy. They provide consumers with flexibility, higher spending limits, purchase protection, and more. It is well established that credit cards are the face of the modern digital economy. The increased use of payment cards contributed an additional $245 billion to consumption across 70 countries between 2015 and 2019.

In response to this global change, credit card spending in Bangladesh rose to 26.69 billion BDT in September 2024, marking an 18.63% increase from 22.49 billion BDT in September 2023. This highlights significant year-over-year growth in credit card usage. Only in September 2024 did credit card spending see a monthly increase of 14.4%.

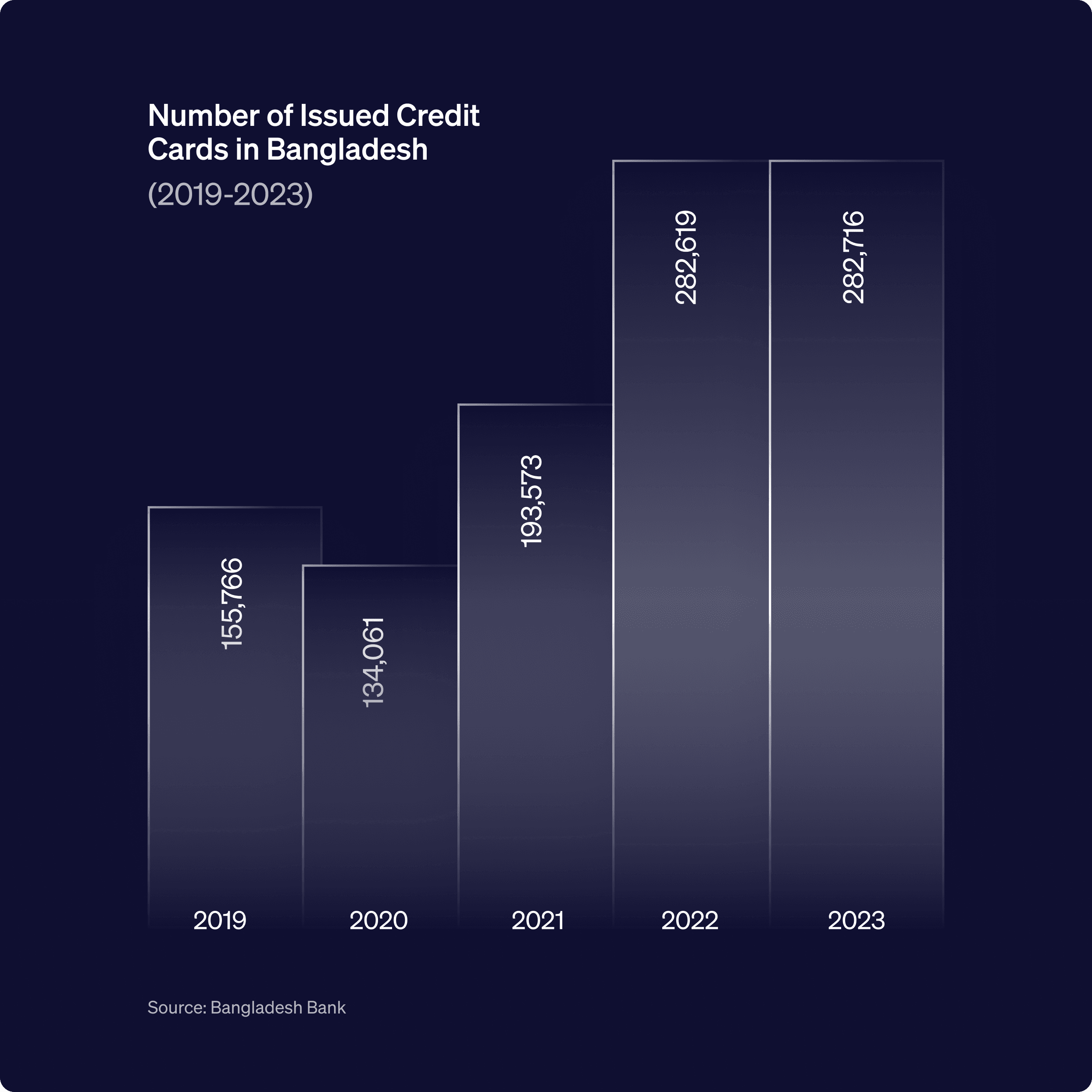

The number of credit cards issued in Bangladesh also rose considerably in recent years. A total of 282,716 credit cards were issued in 2023, almost double the number issued four years earlier in 2019.

Foreign remittances play a very powerful role in the Bangladeshi economy. Wage earners and the digital workforce collectively contribute to a monthly remittance inflow exceeding $2 billion. A considerable share of that comes from freelancers and remote workers contributing to one of the biggest pots of Bangladesh's economy. And yet, there's no straightforward way to avail a credit card for remote employees and freelancers based in Bangladesh whose contributions have become increasingly important to the economy.

They face multiple challenges, like proof of income verification, which leads to rejected applications, wasted time, and disheartenment. With easier access to credit cards, remittance earners can maximize their spending, giving the economy the boost it needs.

So, why do financial institutions still overlook this growing workforce when issuing credit cards?

Discrimination or a Fault in the System?

The story of credit cards in Bangladesh is quite different for employees working for local employers. With physical offices, full-time employment agreements, permanent employment documentation, and other strong proofs, locally working employees find it relatively straightforward to get a credit card. While local companies pay their employees based on Bangladesh's market rates, remote workers earn significantly more by tapping into global salary standards.

Banks readily offer credit cards to local employees making as low as $215 per month yet routinely reject remote workers with monthly incomes of $2,000 or more – highlighting a puzzling disconnect in the financial system.

Despite proven track records on platforms like Upwork and Fiverr and even employment with prestigious global companies, remote workers face persistent rejection from local banks. Their international credentials – which would open doors anywhere else – carry surprisingly little weight in their home country's financial system.

Digital nomads bring thousands of dollars in remittances to the country. They are an asset to any growing economy and deserve to be facilitated with the basic necessity of a credit card.

Remote workers often find themselves in a documentary grey area. Unlike the clear-cut salary certificates and employer letters that local jobs provide, remote work arrangements can be more fluid – with payment proofs from various platforms, informal email contracts, or digital agreements that don't match traditional banking requirements.. Most freelancers are paid task-based, hourly wages, while others work on contractual projects. This also means varying amounts of income each month. On top of that, all they have to show for that is a digitally signed document, and sometimes not even that, just proof of income.

While the general public or any third party may perceive this as a fault in the system, freelancers might perceive it as discriminatory behavior, and they won’t be totally wrong to do that.

The remote workforce represents a new class of financially savvy professionals who have mastered international money management. Their demonstrated ability to handle complex financial flows suggests they could be among the most reliable credit card holders. Banks that adapt their evaluation criteria to include remote work credentials could gain early access to this valuable and growing market segment.

The Current Situation of Freelancer Credit Card Applications

Over the last 10 months, we have created a community of freelancers and remote workers from all over Bangladesh with nearly 40,000 members. The group has become a platform for the underrepresented community of freelancers and remote workers to voice their concerns, share challenges, and most importantly, support one another. This community is a reliable source of understanding the challenges the remote workers face in Bangladesh.

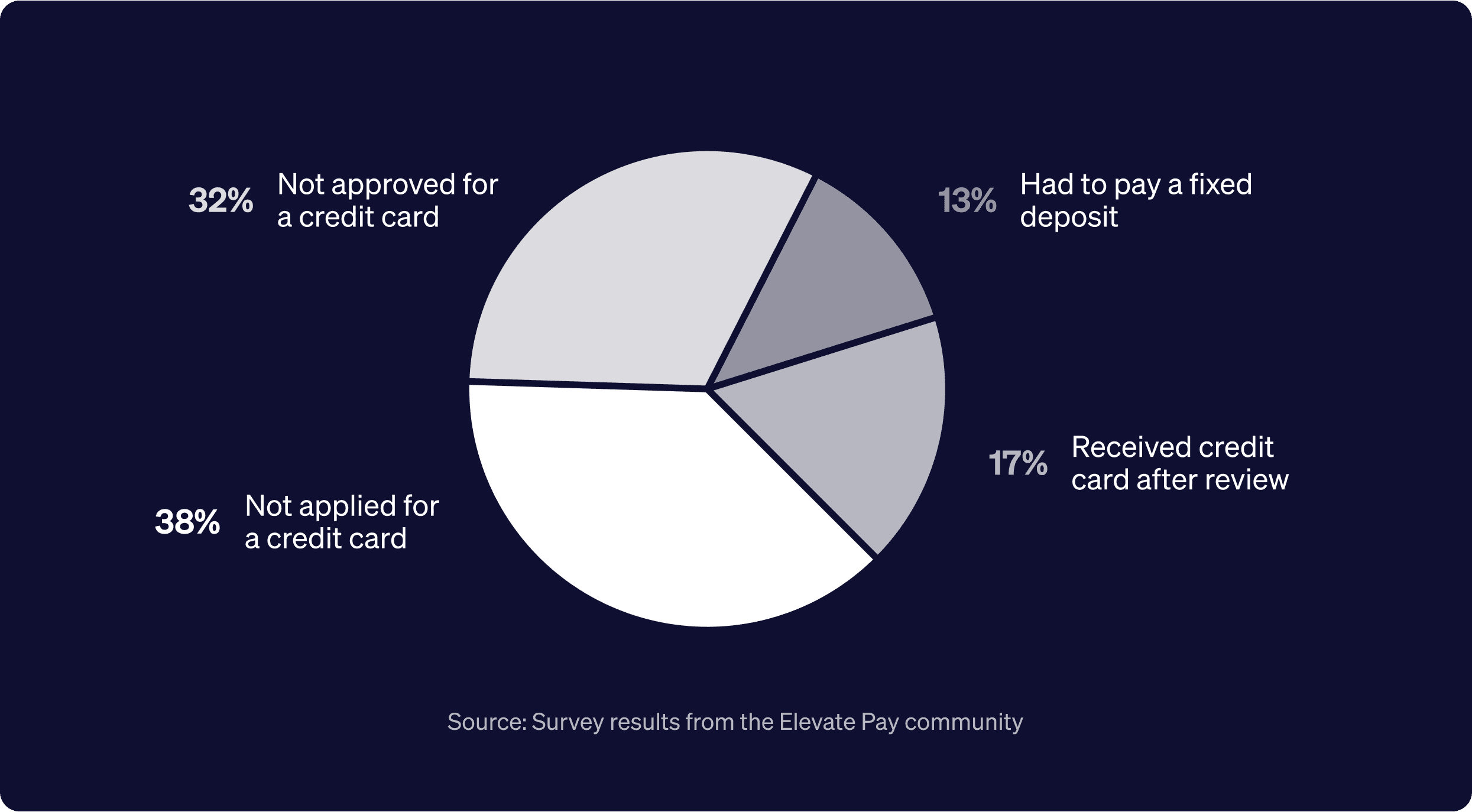

We conducted a poll within the group to learn about members' experiences with credit card applications as remote workers or freelancers. A total of 150 responses were collected, distributed across four options.

38% had not yet applied for a credit card.

32% were not approved for a credit card.

13% had to pay a fixed deposit.

Only 17% successfully obtained a credit card, with many citing a lengthy and challenging document review process.

This ongoing issue highlights a critical need for attention and resolution.

To get more insights into their responses, we left the comments section open and asked them to share their experiences. It showed that some consumers could get approved for a credit card, but the same documentation did not work for consumers visiting different branches of the same bank. The experience of Razib Hasan, a participant in the survey, was not much different. He said:

“I have a credit card with NRB Bank Limited; they approved it without much hassle.

City Bank AMEX also approved my application, but the credit limit they offered was quite low. On the other hand, EBL declined to proceed with my application as they don’t consider freelancers eligible for credit cards.

Getting a credit card can be tricky for freelancers or remote workers without making a fixed deposit. To improve your chances, you’ll typically need: Proof of income (like contracts or employment letters from clients). Payment receipts from platforms such as Wise or Payoneer”

This sums up the situation and shows how much time and effort each remote worker has to put into getting a credit card. More importantly, it tells us that no local banks are ready to take the next step in facilitating freelancers and redefining their credit card compliances to conform to their needs.

Another participant in the survey added:

“DBBL refused to give me a credit card with a remote job, as did some other banks. With a fixed deposit receipt, I got a platinum visa from EBL.”

Fixed-deposit credit cards are not a solution. Fixed-deposit credit cards offer the worst of both worlds: they lock up your money while providing minimal credit benefits. With Bangladesh's high inflation rate eating away at the deposit's value year after year, consumers essentially pay twice – first through the erosion of their deposit's purchasing power and then through hefty card fees and charges. Add in the restrictive credit limits, often just 80-90% of the deposit amount, and these cards fail to deliver the financial flexibility that credit cards are meant to provide.

There is a generalized belief that credit cards are a no-go zone for remote workers. Therefore, it is our educated guess that those who have not applied for credit cards are unaware of the benefits or very well aware of the unfriendly environment for freelancers and remote workers.

This leads to only one conclusion: there is no fixed path or set of instructions that a digital nomad in Bangladesh can follow to get their credit card application approved.

A freelancer ID card issued by the Bangladesh government might be one way to work around the situation. Since it is a government-issued document, banks recognize it as legitimate proof of your freelancing efforts, making it easier for you to get a credit card. However, getting a freelancer ID card is a whole different story.

So, the problem remains, and credit cards for freelancers are still a challenge.

Credit Card Eligibility, Challenges, and Solution

Current requirements for a credit card application in Bangladesh are pretty stringent. You need:

Traditional Proof of Income

Good credit history

Age 21 years

Collateral or fixed deposit (in select cases)

Full-time employment status

These requirements align poorly with the realities of modern employment, particularly for freelancers and gig workers. Traditional income proof, such as pay slips or employer certifications, excludes many who earn substantial, often in global currencies but experience fluctuating cash flows. Additionally, people are evaluated for their credit score, but no central credit scoring agency exists in the country. Users do not know their score or have any clue about how they can improve it. It solely relies on banking history.

Young professionals are a significant part of the freelancing workforce and struggle due to a lack of prior credit and banking history. At the same time, the emphasis on salaried jobs ignores the growing contribution of self-employed individuals and small business owners.

These policies must be revised to accommodate the rapidly expanding digital economy and represent a missed opportunity for banks to tap into a dynamic, high-potential demographic, ultimately hindering financial inclusion and economic growth.

As a result, this excludes a vast pool of workers from the credit card eligibility pool because of:

Income Inequality

Limited Access to Documentation

Lack of traditional proof of income

Overemphasis on Formal Employment

This leads to a limited pool of eligible applicants, which hinders the growth of credit card adoption and impacts banks and financial institutions looking to expand their user base.

What needs to change?

A potential solution is to change credit card applicants' requirements and eligibility criteria. This can be done by:

1. Simplifying Eligibility:

Introducing lower-income thresholds or beginner credit cards with smaller limits could make qualifying easier for more people. This would help new freelancers and local employees with no formal employment documentation.

Supporting Alternate Incomes:

Accepting proof of alternative income sources, such as freelance contracts or gig economy earnings, could widen the eligibility pool. High-earning freelancers will look for high credit limits, and accepting their alternate income proofs can solve the problem.

Building Credit History Alternatives:

Allowing utility bill payments or rent payments as indicators of creditworthiness could help first-time applicants. Any user’s monthly payments are a sign of authenticity, and considering utility bills could foster a much-needed solution.

Non-Traditional Credit Evaluation:

Use AI and machine learning to evaluate an applicant's financial habits, such as spending consistency, savings, or transaction patterns. Include rent, utility payments, and mobile bill records as alternative indicators of creditworthiness.

Dynamic Credit Limits:

Offer cards with adjustable credit limits based on real-time income fluctuations, addressing the irregular cash flows typical of freelancers.

By addressing these barriers, banks and financial institutions can make credit cards more accessible to a broader section of Bangladesh's population. Banks need to do this before it’s too late. They have other countries to learn from, such as Brazil.

Banks Can’t Afford to Wait for Fintech to Dominate the Game

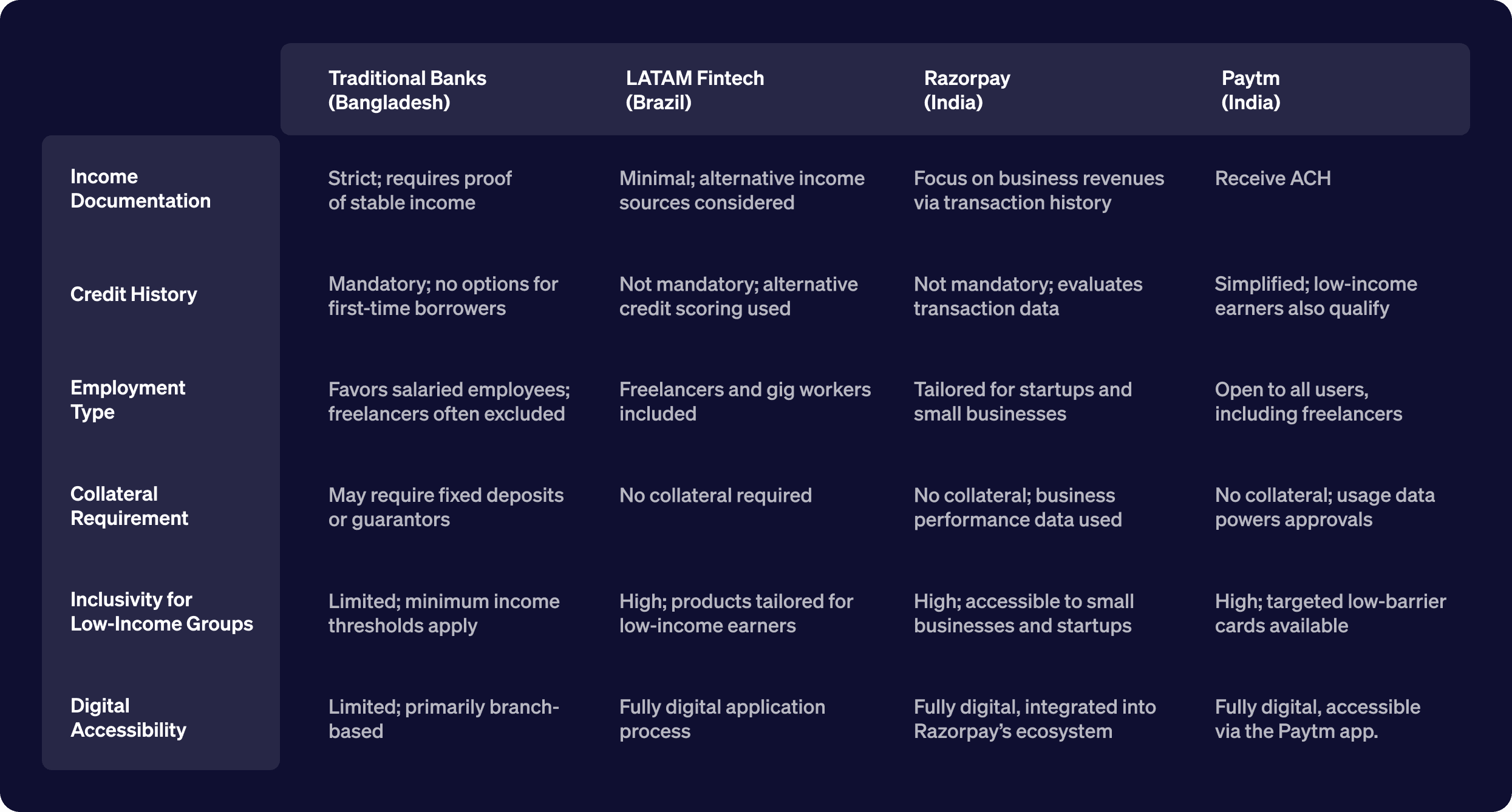

Brazil’s experience with financial inclusion offers a powerful lesson for Bangladesh. When freelancers and self-employed individuals in Brazil struggled to access credit cards, fintech companies like Nubank stepped in, offering easy-to-access cards with minimal requirements and alternative credit evaluation methods. These fintechs disrupted the market by recognizing the untapped potential of freelancers and leveraging innovative solutions to meet their needs. In response, traditional banks had no choice but to compete, lowering their own barriers to entry and introducing more inclusive financial products.

Another example to take inspiration from are the Indian Fintech companies RazorPay and PayTM. RazorPay launched credit cards with flexible eligibility requirements and models tailored to help freelancers. They used alternative credit scoring models, including payment histories, earnings from freelancing platforms, and digital wallet transactions.

Paytm, on the other hand, partnered with banks to launch co-branded credit cards, such as the Paytm SBI Card, with lower eligibility criteria and attractive features like cashback and rewards tailored to digital payments. They also used digital data and alternative payments to assess users' eligibility to increase financial inclusion. Paytm also partnered with non-banking financial companies (NBFCs) to extend credit to underserved segments, bridging the gap left by traditional banks.

This is how fintech in other countries defeated local banks and rapidly grew by tapping into a huge market. Local banks in Bangladesh could take a page out of their book and bring home this large user base instead of waiting for a fintech revolution to do it.

How Traditional Banks Compare to Modern Solutions

Bangladeshi banks' credit card issuance and management strategies differ greatly from those of international fintech-led solutions, such as those implemented in Brazil and India. Let’s do a comparative analysis to inspire actionable strategies for Bangladeshi financial institutions.

Bangladesh stands at a similar crossroads as Brazil and India did a few years ago. The market is ripe for disruption with its rapidly growing freelance workforce and increasing reliance on digital payments. If banks don’t act now, fintech competitors will seize the opportunity, dominating a lucrative market and leaving traditional banks to play catch-up.

The question is: Will Bangladeshi banks lead the charge or risk losing the race?

Traditional banks in most countries have been slow to adapt to the needs of changing, evolving users. On the other hand, fintech startups fully understand and cater to the needs of freelancers, remote workers, or even small and digital business owners.

Facing such a challenge, traditional banks may not be able to cater to these needs solely and may want to consider partnering with a fintech company. Traditional banks can collaborate with fintech companies like bKash to create hybrid credit cards or wallets that incorporate both traditional banking features and fintech innovations.

They can also use fintech’s data analytics capabilities to assess freelancers' financial behavior and offer personalized credit solutions. Eventually, they can look into more modern solutions, like launching virtual credit lines that freelancers can access through mobile apps, bypassing physical card requirements while maintaining spending flexibility.

Our Commitment

At Elevate Pay, our commitment to freelancers and remote workers extends far beyond simplifying USD banking. We are dedicated to going the extra mile by providing a platform where freelancers and remote workers can voice their demands, share suggestions, and highlight the challenges they face. We aim to actively collaborate with relevant stakeholders to address these issues and drive meaningful change.

In line with this mission, we are open to working with any bank or fintech that is willing to partner with us to solve these pressing challenges. Elevate Pay is ready to assist interested institutions in simplifying alternative income verification processes and evaluating remittance records for our users. Please reach out to me at tanvir@elevatepay.co if you're interested in a collaboration to solve this issue. Together, we can create innovative, tailored solutions that empower freelancers and remote workers, bridging the gaps in credit access and driving financial inclusion in Bangladesh.

Conclusion

Bangladesh stands at a critical juncture in its economic journey, poised to become the 9th largest consumer market in the world by 2030. The trajectory of this growth will depend on how effectively the financial sector includes its burgeoning freelance and remote workforce—dynamic contributors bringing billions in remittances annually. Credit cards are not merely a convenience but essential financial tools that ensure smoother cash flow, bridge income gaps during job transitions, and bolster spending, fueling economic activity and growth. Considering the role of credit cards in the consumption market, this growth can be halted or accelerated depending on Bangladesh banks' decisions regarding their freelance workforce.

Freelancers and remote employees represent a high-potential demographic that remains underserved. Despite their growing importance in the global and local economy, traditional financial institutions rely on outdated models, excluding this workforce from accessing credit products.

The global gig economy has already demonstrated the power of financial inclusion. In Brazil, fintechs stepped up when traditional banks faltered, creating innovative solutions for freelancers and remote employees. By the time banks reacted, fintechs dominated the market. This is a cautionary tale for Bangladeshi banks: the opportunity to lead is here, but the window to act is shrinking. If they fail to adapt, fintech disruptors will capitalize on this untapped market, leaving banks to struggle in a game of catch-up.

Now is the time for Bangladeshi banks and fintech companies to redefine their approach. By catering to the needs of freelancers and remote employees, they can open doors to a vast, high-potential market. Tailored credit and lending products can be a game-changer for the economy, banks, freelancers, and remote workers.