Payoneer in Pakistan: Everything You Need to Know

Mesan Ali

For a long time, Payoneer has operated in Pakistan as a rare international payment platform. When freelancing was rare in Pakistan, Payoneer was the go-to option for everyone to receive international payments.

Pakistan has grown massively as a freelancing nation, and remote work has become a significant contributor to the country’s economy. In these rapidly changing times, Payoneer is still playing an essential role as a payment solution platform, but now with many more competitors.

What is Payoneer?

Payoneer is an international multicurrency payment platform used by freelancers, remote workers, business owners, and others. It allows you to receive payments from overseas clients for any goods or services you provide.

Payoneer in Pakistan: What it offers?

Payoneer has been a big help for freelancers and business owners in Pakistan for over a decade. Allowing them to complete international transactions and receive money in their local bank account. It also enables Pakistanis to own a multicurrency account to help them manage a global business.

Creating a Payoneer Account in Pakistan

Creating a Payoneer account in Pakistan is relatively straightforward. However, you first need to meet the criteria for setting up a Payoneer account, which is:

You are at least 18 years old.

Must have CNIC.

You must have a local bank account.

You have an active mobile number.

Have an active email ID.

If you meet the criteria, you can sign up for your Payoneer account. Here’s a step-by-step approach to how you can do it:

Got to the Payoneer website

In the top right, click on Register

Select the account category that suits you.

Choose what you would like to use the account for.

Select the monthly volume that you need.

After reviewing the recommendation, click register.

Sign up as an individual or a registered company

Complete the required personal and security details

Submit.

Once you submit your registration request, you can start using the account. Remember to share your local bank account details so you can withdraw money from Payoneer to your bank account.

You can link your Payoneer account to Fiverr, Upwork, and other freelance platforms if you are a freelancer. For business owners, it is important to share their business registration details so that their accounts can be linked.

Using Payoneer in Pakistan: What Can You Do?

A Payoneer account has a wide range of uses in Pakistan. You can use your Payoneer account to:

Receive international payments from overseas clients in currencies like USD, EUR, GBP, and JPY.

Payoneer facilitates seamless transactions through online marketplaces such as Upwork, Fiverr, Amazon, Airbnb, eBay, Etsy, and Alibaba.

Send payments to other Payoneer users or international suppliers and vendors.

You can withdraw funds from your Payoneer account to local Pakistani bank accounts, with faster transfers available through HBL's mobile app.

Utilize the Payoneer Mastercard for online and offline purchases globally and ATM withdrawals.

Manage a multi-currency account to hold and transact in various currencies for global business operations.

Create and send invoices to clients directly through the Payoneer platform.

Access Global Payment Service to receive payments with local bank account details in different currencies.

Convert currencies within your Payoneer account for international transactions.

All these features make Payoneer a unique solution for Pakistanis. However, along with these uses, there are some things to remember.

Payoneer has a unique partnership with HBL, allowing instant transfers to local HBL accounts from Payoneer. So, transfer to other supported banks like MCB. Standard Chartered, Faysal Bank, and Citibank can take longer.

You can get a Payoneer Mastercard for your usage and ATM withdrawals; however, Payoneer charges $3.15 for every ATM withdrawal, and the bank can charge you more on top of this.

Nonetheless, the Payoneer MasterCard is useful, and knowing how to get one can be helpful.

How to Get the Payoneer MasterCard in Pakistan?

Payoneer offers its MasterCard in Pakistan for a fee of $30. This means you must have at least $30 in your account to be eligible to apply. You can apply for the card by opening your Payoneer account settings and going to ‘Payoneer Cards.’ If you are eligible, you will see the option to order the card, which will be delivered within 30 days.

You can use the card online, at physical locations, and ATMs.

What Fees and Charges are associated with a Payoneer account in Pakistan?

Payoneer makes international transactions very easy for Pakistani users, but at what cost?

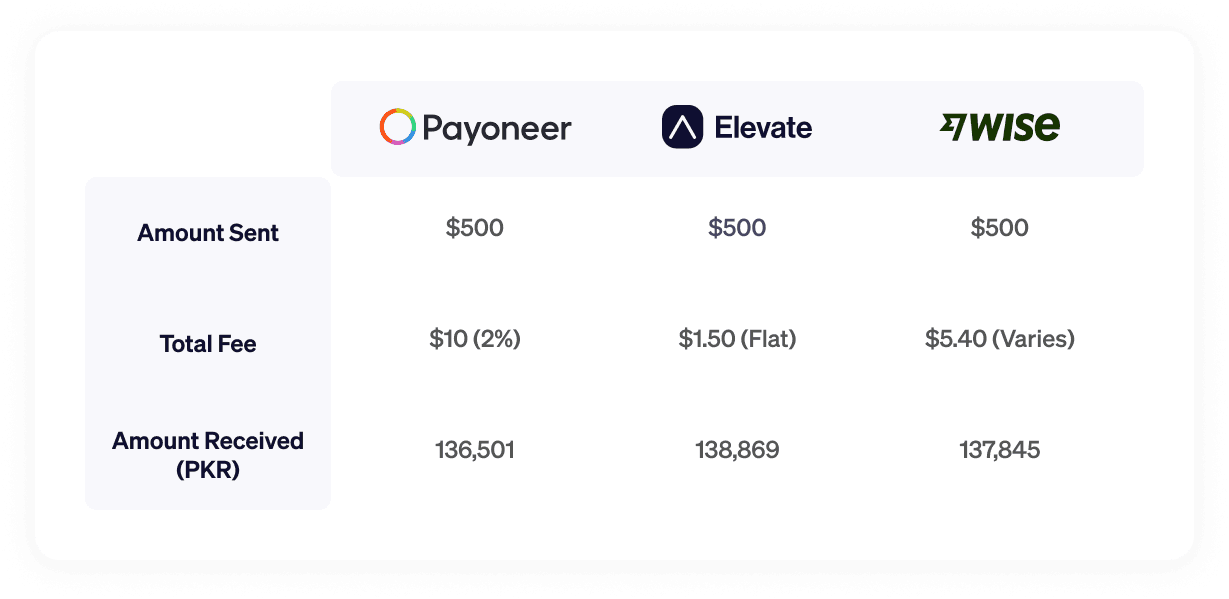

Conversion, transaction, and withdrawal fees are the fees you pay as a Payoneer user. Let’s break down what and how much Payoneer charges for different types of transactions by a Pakistani user.

Withdrawal Fee

A 2% fee applies to transactions to transfer GBP, EUR, or USD to your local bank account. For example, you would pay $20 to transfer $1000 to your local account.

Transaction Fee

Another transaction fee is when your client pays you. This varies depending on the method your client uses to pay you.

3% if your client uses a credit card to pay you.

1% transaction fee when clients use a bank account transfer to pay you.

There is no fee if it is paid directly from another Payoneer account.

Conversion Fee

This is one fee from Payoneer that is not very transparent. Every time a currency is converted to PKR, a conversion fee is charged on top of the given exchange rate.

Alternatives to Payoneer in Pakistan

While Payoneer is great, alternative solutions are out there that better suit your needs. The two major alternatives are:

Elevate Pay

Unlike others, Elevate Pay is highly transparent about its fees. Tailor-made for emerging markets like Pakistan, Elevate Pay allows you to open a free USD bank account sponsored by Bangor Savings Bank and receive payments from clients and freelance platforms.

Elevate Pay offers the best FX rates and a flat fee of $1.50, ensuring you will not lose money during your transfer. You can set up your Elevate Pay account in three simple steps by downloading the iOS or Android App.

Also Read: 7 Wise Alternatives in Pakistan

Wise

Another known payment platform that has been a prevalent option for Pakistanis in the recent past. Wise supports you with seamless transfers to Pakistan from supported countries and a USD account. It also has a debit card option. Although Wise is transparent about its fees for each transaction, it can be relatively high.

However, Wise is not currently offering new accounts to Pakistanis, which means the platform can only be used by existing users.

Here’s what a $500 transaction to Pakistan looks like on each of these platforms:

Try Elevate Pay now to experience the best conversion rates and smooth USD transactions.

What Makes Elevate Pay the Smarter Choice For Pakistanis?

Elevate Pay was designed to support freelancers and remote workers in emerging markets. Economic instability and similar factors cause many payment platforms to drop operations in rising economies. However, Elevate Pay was tailor-made to strive in such markets and stand tall against economic challenges.

Most payment platforms are focused on more established economies and, therefore, struggle to maintain their services in struggling ones. Hence, a platform like Elevate Pay is the ultimate solution to your needs as a freelancer or a remote worker in Pakistan.

Conclusion

Payoneer is an essential name in the payment industry, and its services in Pakistan are exceptional. From a simple account-creating process to using the platform to receive money in multiple currencies, you can do it all with the help of this article. You can also create a Payoneer MasterCard and know everything else that you can do with your account.

Finally, understand all the costs and charges associated with the account before proceeding and know all the other great options available to you to make an informed decision.