Payoneer in Bangladesh: Features, Uses, Alternatives and More

Mesan Ali

Payoneer launched in Bangladesh in the early 2010s and was one of the few payment solutions for freelancers. Back then, freelancers struggled to receive their international income and transfer it to their local accounts. Payoneer solved this problem by offering better fees, exchange rates, and faster transactions compared to local banks. Shortly after, Payoneer became widely popular among freelancers in Bangladesh.

Today, Payoneer is meeting the market's changing needs and has evolved its services to serve others in similar roles.

What is Payoneer?

Payoneer is a global platform for handling payments in multiple currencies. It is widely used by freelancers, remote professionals, business owners, and others. It facilitates receiving payments from international clients for the products or services you provide.

What Payoneer Offers in Bangladesh?

Over the years, Payoneer has evolved to meet growing and diverse demands in Bangladesh's market. It now supports payments for e-commerce, affiliate marketing, and online marketplaces alongside its original role of assisting freelancers. The service enables users to receive payments in multiple currencies, withdraw funds to local bank accounts, and use the Payoneer card for ATM withdrawals.

How Do You Create a Payoneer Account in Bangladesh?

Creating a Payoneer account in Bangladesh is a simple process, provided you meet the eligibility criteria:

You must be at least 18 years old.

Possess a valid CNIC (National ID), passport, or driving license for identity verification.

Have a local bank account to link for withdrawals.

Own an active mobile number for communication and account security.

Have a functional email ID for account setup and notifications.

If you meet these requirements, follow these steps to create your Payoneer account:

Go to the official Payoneer website.

Click on "Register" in the top-right corner.

Choose the type of account you wish to create (individual or business).

Specify the intended use of your account (e.g., freelancing, business payments).

Select your expected monthly transaction volume.

Review the recommended account features and click "Register."

Complete the form with your personal and security details (name, address, password, etc.).

Submit the required documents for verification (e.g., a copy of your CNIC or passport and proof of address).

Click "Submit" to finalize your application.

After submitting your registration request, you can begin using your Payoneer account. Be sure to provide your local bank account details to enable fund withdrawals from Payoneer to your bank.

For seamless payment processing, freelancers can link their Payoneer account to platforms like Fiverr, Upwork, and other freelancing sites. Business owners must share their business registration details to integrate their accounts effectively with Payoneer.

Payoneer in Bangladesh: An Overview of Its Features and Uses

A Payoneer account offers versatile solutions for individuals and businesses in Bangladesh. Here’s what you can do with it:

Accept payments from overseas clients in multiple currencies, including USD, EUR, GBP, and JPY.

Seamlessly handle payments from platforms like Upwork, Fiverr, Amazon, Airbnb, eBay, Etsy, and Alibaba.

Transfer funds to other Payoneer users or pay international suppliers and vendors.

Withdraw money from your Payoneer account to local Bangladeshi bank accounts.

Use the Payoneer Mastercard for online and offline purchases globally or for ATM withdrawals.

Hold and transact in multiple currencies to support global business operations.

Generate and send invoices to clients directly through Payoneer.

Receive payments via local bank account details in various currencies.

Convert funds between currencies within your Payoneer account for international transactions.

All these features make Payoneer a unique solution for Bangladeshis. However, there are a few important things to consider. Payoneer has partnerships with several local banks, such as Standard Chartered, MCB, Faysal Bank, and Citibank, allowing users to transfer funds from their accounts. HBL provides quicker processing for faster transactions, particularly with its mobile app. Transfers to other supported banks may take longer, so it's important to plan accordingly when transferring funds.

Additionally, Payoneer offers a Mastercard that can be used for online and offline purchases and ATM withdrawals worldwide. However, each ATM withdrawal incurs a $3.15 fee, with local banks potentially adding extra charges. Despite these fees, the Payoneer Mastercard remains a valuable tool for both local and international transactions, making it useful for Bangladeshis who need global access to their funds.

How to Get the Payoneer MasterCard in Bangladesh?

To get a Payoneer Mastercard in Bangladesh, you must first create a Payoneer account. After signing up, you must fund your account with at least $100. Once your account is funded, you can request the Payoneer Mastercard. The card generally takes 2-3 weeks to be delivered to your address. Once you receive the card, you can activate it and link it to your Payoneer account. Once activated, the card can be used for online purchases, ATM withdrawals, and in-store payments.

What Fees and Charges Incur For a Payoneer MasterCard?

You need to be mindful of some fees and charges before using the Payoneer Mastercard. These charges are:

Activation Fee: A one-time fee of $29.95 to activate the card.

Monthly Maintenance Fee: Payoneer charges a monthly fee of about $3.95 to keep the card active.

ATM Withdrawal Fee: In addition to any fees that the ATM operator might charge, there is a fee of $2.50 for each ATM withdrawal.

Foreign Transaction Fee: When using the card for international transactions, a 3% fee is charged on the transaction amount.

One fee that is typically not transparent from Payoneer is the conversion fee. When you transfer currency to your local account, Payoneer charges a conversion fee of 2% on top of the exchange rate applied.

Alternatives To Payoneer in Bangladesh

Payoneer has left its mark in Bangladesh as one of the oldest payment solutions. However, over the years, some competitors have taken over the mantle because of their transparent policies, better exchange rates, and more. Let’s take a look at some of these competitors.

Elevate Pay

Elevate Pay is tailored for growing economies like Bangladesh and strives to offer services specific to local user needs. Unlike other solutions focused on Western Markets, Elevate Pay understands the day-to-day struggles of Bangladeshi users.

Elevate Pay brings you free-of-charge USD accounts provided by Bangor Savings Bank. You can receive USD payments from anywhere in the world and hold them in your USD account for as long as you need. You also get the best exchange rates, flat $1.50 fees, and instant transactions to your local account—all these services and 24/7 support to help you with your transactions.

Wise

Another great option for receiving international funds is Wise. What makes Wise Unique is its multi-currency account that allows you to store over 50 currencies. This allows you to send, receive, and hold funds like a local account.

Wise provides a debit card linked to this account, which can be used for global purchases and ATM withdrawals. Additionally, Wise charges no hidden fees on currency conversion and uses the mid-market exchange rate; however, their costs can be relatively higher than some other solutions.

Xoom

Unlike other payment solutions, Xoom is just a money transfer service. It offers no account but allows users to send money to over 160 countries. Xoom is renowned as a subsidiary of PayPal, which is unavailable in Bangladesh.

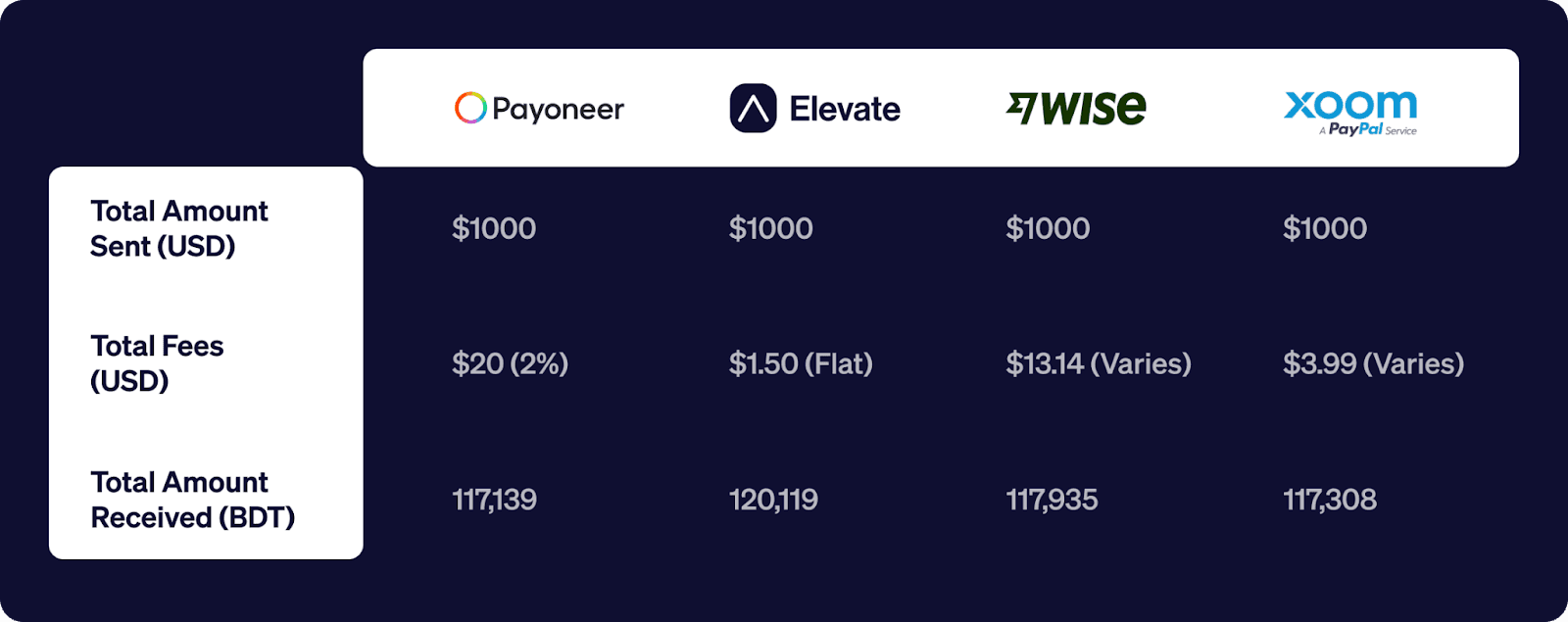

Let’s see how all these platforms compare for a $1000 transaction to your local account.

(FX Rates - December 12, 2024)

Try Elevate Pay now to complete your USD to BDT transactions with the best exchange rates and low fees.

Why Should Bangladeshis Pick Elevate Pay?

Rising economies like Bangladesh always see ups and downs. This leads to poor service and consistency from other platforms more focused on Western markets. Elevate Pay is tailor-made for emerging markets like Bangladesh and strives to offer seamless and reliable services in the country.

More than that, Elevate Pay is building a community to connect freelancers and remote workers, give them a voice to share their opinions and challenges and address their concerns. Join the Elevate Pay Bangladesh Community Group on Facebook and connect with thousands of freelancers and remote workers who are always helping each other out.

Conclusion

Payoneer has established itself as a trusted platform for freelancers, businesses, and individuals in Bangladesh, offering a robust solution for cross-border transactions. By understanding how to create and optimize your Payoneer account, you can take full advantage of its versatile features, including international payment options and the Payoneer Mastercard.

Exploring these capabilities helps you manage global transactions with ease. With innovative competitors like Elevate Pay entering the market, Bangladeshis now have access to even more dynamic and tailored solutions for their financial needs. The evolving landscape promises exciting opportunities for users seeking efficient payment platforms.