How Do I Use My USD Account Details?

Mesan Ali

Only when you create a USD account, you realize that USD bank account details might be slightly different compared to conventional banks in your country. This often leads to confusion for new users. In this article, read all about where you can find your USD account details in the Elevate Pay app and how to use them.

How Do I Find My USD Account Details?

Finding your USD account details in the Elevate Pay is very straightforward:

Login to Your Elevate Pay app

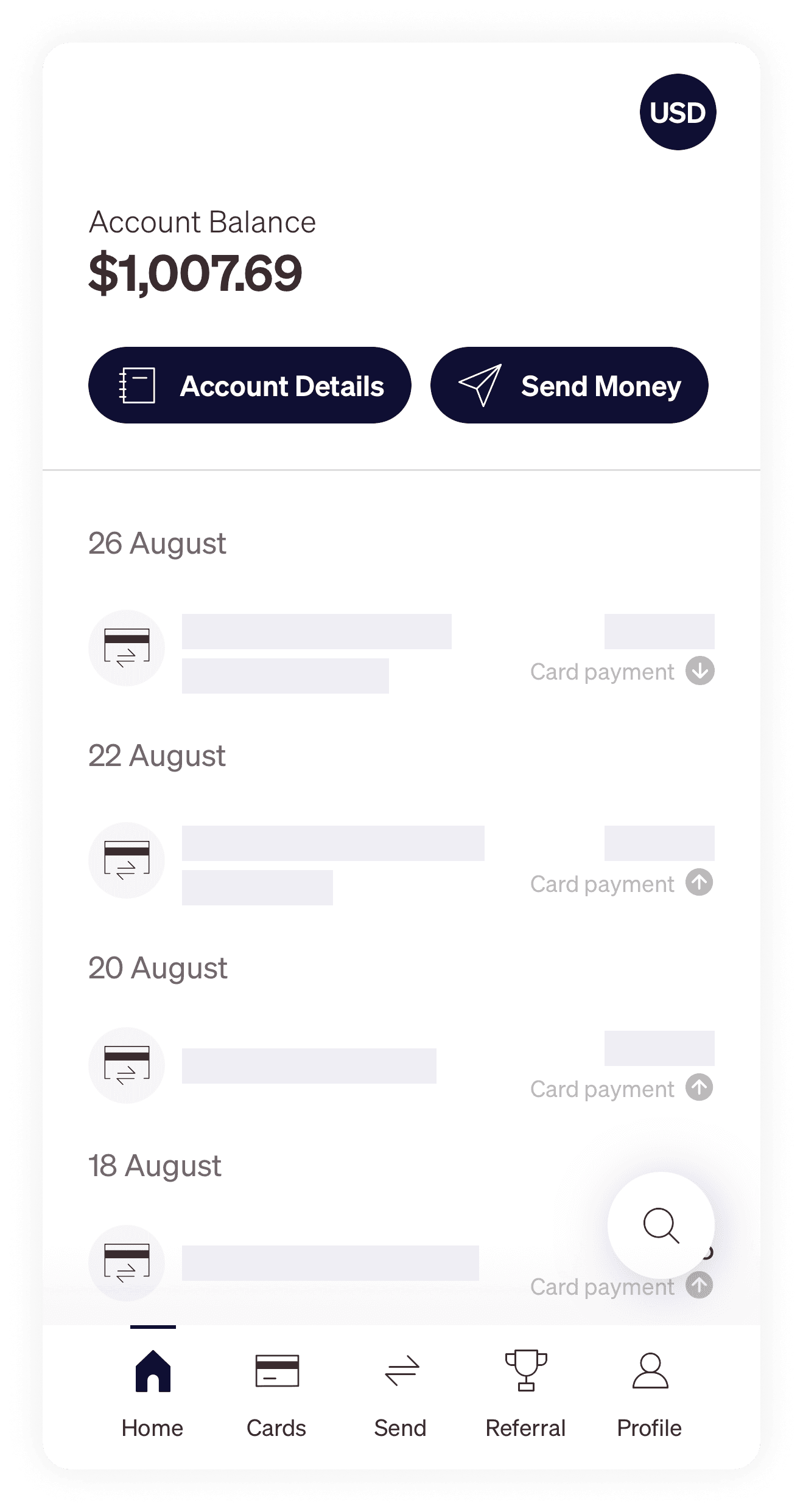

Tap “Account Details” on the app home screen.

You can find the account details button on the top left side of your screen as shown below:

Once you tap on the account details screen, you will be redirected to the screen with all your account details.

What Are the USD Account Details?

Similar to your local bank account details, these are the account details of your very own Elevate Pay USD bank account. You can use these details to receive USD in your account by sharing the details with the sender.

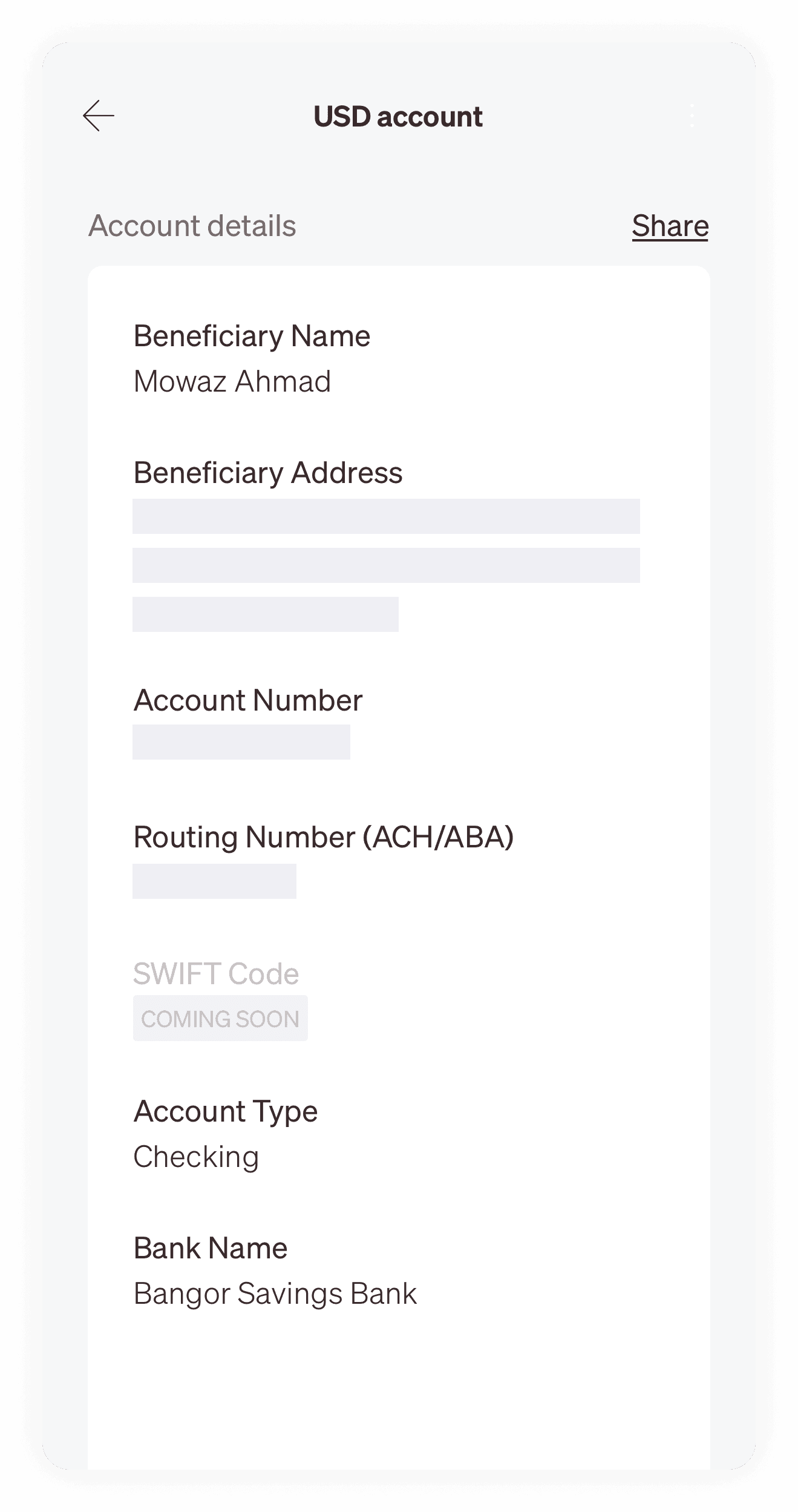

The Account details screen on your Elevate Pay app looks like this:

The account details available for your Elevate Pay Account are:

Beneficiary Name

This is the account holder's name as it appears on your Elevate Pay account.

Beneficiary Address

This is your current address, as per Elevate Pay records.

Account Number

This is a unique identifier number specific to your Elevate Pay bank account. It tells precisely which account to access for any transactions.

Routing Number

This is a nine-digit code used to identify the specific financial institution where your account is held. It ensures that the transaction is directed to the right bank during transfers.

Account Type

This tells if you have a checking or savings account. Currently, Elevate Pay only offers checking accounts.

Bank Name

This is the bank's name that provides the USD account for Elevate Pay users. You will always see Bangor Savings Bank's name when accessing these details.

Bank Address

This is the physical address of Bangor Savings Bank, which you might need occasionally for some transactions.

How to Use USD Account Details?

The account details refer to the bank account provided by Bangor Savings Bank. You ideally need the beneficiary name, bank name, account number, and routing number to receive funds. In some cases, you might need additional information also provided by Elevate Pay, as seen above.

To receive funds in your account, you can share these account details with your company or friends or use them with any freelance platform.

Since it is a USD account, you can only receive funds in USD. Funds transferred in any other currency will be sent back to the sender.

When receiving funds in your Elevate Pay account, please keep in mind the transaction limits to avoid any inconveniences. The two limitations are:

The maximum limit per transaction is $3000.

The total transaction amount shouldn't exceed $20000 in 30 days.

How Do You Receive Funds From Inside The US?

You will most likely receive an ACH transfer to receive funds from a US-based employer or any US connection of yours. For an ACH transfer, you need to share the following details with your client:

Beneficiary Name

Account Number

Routing Number

Bank Name

Account Type

You may also receive funds from some clients via wire transfer. For that, you might need to provide additional information like:

Bank Address

Beneficiary Address (in rare cases)

Read Also: The Ultimate Guide To Your Elevate Pay Account

Can I Receive Funds From Outside The US?

You can receive funds in your Elevate Pay account from from US Banks, Clients, and Freelancing Platforms if the payment is in USD. Payment to an Elevate Pay account in any other currency will be returned to the sender.

You can share these account details with the sender by tapping the “share” button on the account details screen. You should never share these details with someone you do not trust.