Bangladesh’s Freelancer ID Card: A Real Benefit or Just Empty Promises?

Tanvirul Islam

Freelancer ID Card Bangladesh was an initiative by the Bangladeshi government to help freelancers and remote workers get professional credibility. Freelancers deserve to be recognized for their occupation and have equal financial inclusion, just like the country's local workers.

Freelancers and remote workers in the country struggle to avail themselves of financial services that require proof of income and other verifications. This is because their remote work destination and income are not considered eligible. This card was the government’s effort to address this shortcoming. It was supposed to give all freelancers a valid identity issued by the government and make them eligible for all financial services.

However, this card was never as widely used.

All About the Freelancer ID Card

The card was announced in November 2020. The Government of Bangladesh, through the ICT Division, Bangladesh Computer Council, and the iDEA Project, launched the Freelancer ID Card initiative. Bangladesh Freelancers Development Society (BFDS) also contributed to its initiation.

Eligibility Criteria

To obtain the Freelancers ID card, one must maintain the following eligibility criteria –

Citizen of Bangladesh (Must have NID Card)

Earned a minimum of $1000 via online work in the last 12 months

Foreign source of earnings.

Can provide proof of contract/job obtained via marketplace/direct client.

Earnings are obtained by providing legal means of service/sale of digital products.

Application Process

Any individual freelancer, freelance team member, or freelance team owner can apply for the freelancer ID card.

Create an account on the official portal for Bangladesh freelancers.

Enter all the required details on the application form.

You must pay a fee of BDT 1,500. If the application is rejected, you will receive a refund minus a 20% administrative fee. This is an annual fee required every year to renew the card.

The verification process may include a document assessment and a video call to confirm the information's authenticity.

Upon successful verification, the virtual Freelancer ID Card will be issued, valid for 12 months.

Is the Freelancer Card Really Helpful?

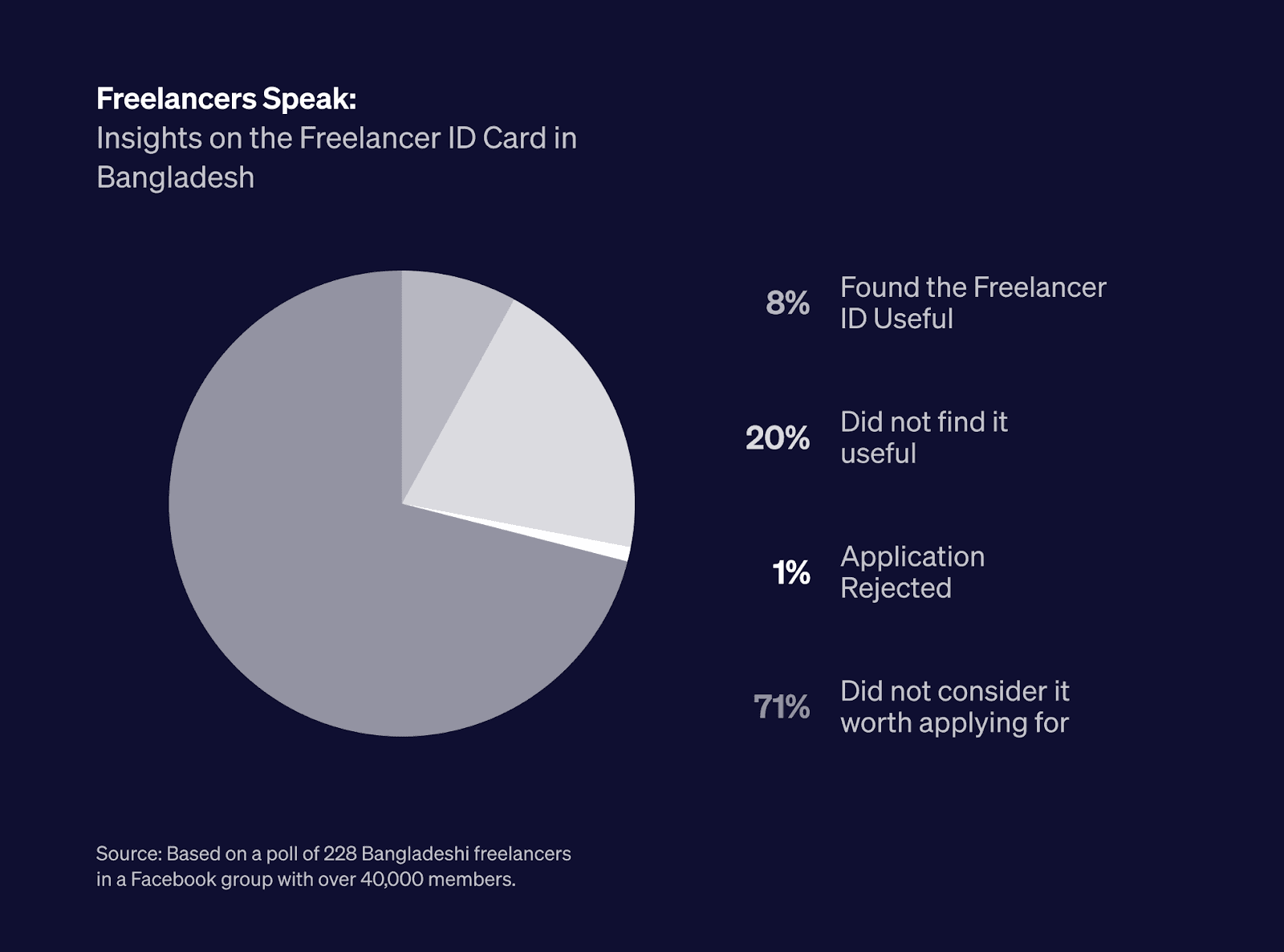

Over the past year, we have created a community of Bangladeshi freelancers and given them a platform to voice and discuss their opinions. The community’s strength stands at over 40,000, with active, high-profile freelancers making their international income living in Bangladesh.

We conducted a poll in this Facebook group to learn about Freelancers’ experience with the Freelancer ID card. A total of 228 responses were recorded, and this is what the results looked like:

Only 8% of respondents said they got the card and it was useful.

20% of the responses claimed they got the card, but there were no real benefits.

Only 1% got their application rejected, showing good acceptance rate.

71% of the participants never applied for the card because they didn’t believe in it.

This shows the shortcomings of this project. There were either no real benefits attached to the card, or they were never properly marketed.

For a deeper overview of the situation, we left the comments section open and asked users to share details about their experiences. We discovered some interesting insights from the responses we got.

One of the participants said:

“First of all, I don’t want anyone to spy on my financial data or to be kept on monitoring. Secondly, Freelancers were supposed to get 4% incentives according to BB circular. But none ever got that. Never saw any initiative from the authorities regarding this. If you don’t get anything in return, investing anything at all is not worth it. All the benefits, such as opening a specialized bank account and everything else you can get without it, just by submitting your invoices and profile information. So, I find it a total waste of money, and your personal data is being stored and monitored by authorities. That’s all.”

This shows that there were concerns of privacy breach with this card, and the benefits offered did not make the card stand out. Another major concern highlighted is the unfulfilled promise of a 4% remittance incentive for freelancers, which led to a lack of trust in government initiatives.

Another respondent stated:

“I think it's a must-have for operating bank accounts and obtaining credit cards as a freelancer. I personally see this as very useful. I obtained mine 3 years ago and have been renewing every year.

The process was pretty smooth, too.”

This response shows that some users are benefiting from the card. Getting credit cards can be a big hassle for freelancers otherwise.

Other responses included “Never Benefited,” “Waste of Money,” and “I applied for it last month, but no updates were received.”

This leads to the conclusion that the card's benefits are inconsistent, potential users are unaware of what benefits they can avail of, and the government did not invest wholeheartedly in this initiative.

What Could be the True Potential of a Freelancer ID Card?

Bangladeshi Freelancers face challenges like lack of financial inclusion, poor recognition, and lack of foreign income benefits, as opposed to wage earners living abroad who are incentivized to send money home.

This freelancer card should have been marketed properly, and the target market should have been informed of all its benefits. This should be the ultimate source of recognition for freelancers, allowing them to receive benefits like credit cards, loans, etc.

The 4% freelancer remittance announced could have been easier to implement, and verifying freelancer income would have been a breeze with this card.

Freelancers should also be able to use the card to maintain a clear record of income for tax filing and leverage its transparency to avail of government benefits such as reduced tax rates on foreign remittances.

How Elevate Pay Can Help?

Elevate Pay's dedication to freelancers and remote workers goes far beyond offering simplified USD banking solutions. We strive to create a platform where freelancers and remote professionals can voice their concerns, share feedback, and bring attention to the challenges they encounter. We aim to actively engage with key stakeholders to address these issues and foster impactful change.

Aligned with this vision, we welcome partnerships with banks and fintech companies eager to collaborate on resolving these critical challenges. Elevate Pay is ready to support institutions in streamlining alternative income verification processes and analyzing remittance records for our users. If you're interested in joining forces to tackle these issues, feel free to contact me at tanvir@elevatepay.co. Together, we can develop innovative, customized solutions that empower freelancers and remote workers, enhance credit access, and promote financial inclusion in Bangladesh.

Conclusion

The Freelancer ID Card has the potential to be a game-changer for freelancers in Bangladesh, offering them the recognition and financial inclusion they deserve. It can address significant challenges such as proof of income, access to credit cards, loans, and other financial services, and ease tax filing with a transparent record of income. However, for this initiative to succeed, responsible institutions must step up and prioritize the needs of freelancers.

Proper marketing of the card, a focus on delivering promised benefits like the 4% remittance incentive, and building trust within the freelancer community are essential steps to make the card a valuable resource. By listening to freelancers’ feedback and addressing their concerns, this initiative can empower freelancers and remote workers in the country.

Institutions like Elevate Pay can complement such efforts by providing innovative financial solutions and working alongside stakeholders to bridge the gaps in financial inclusion. Together, these initiatives can pave the way for a thriving freelancing ecosystem in Bangladesh, fostering economic growth and empowering its digital workforce.